Page 97 - Budget Book FY2020-2021

P. 97

General Fund

Tax Office

www.mcallen.net/departments/tax

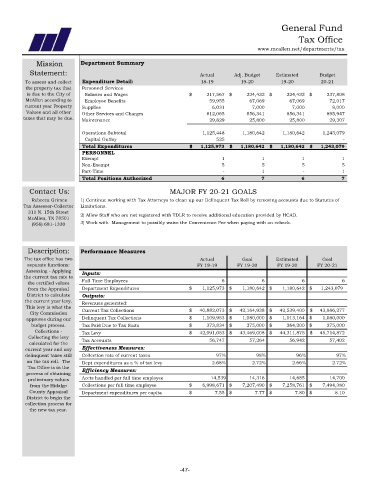

Mission Department Summary

Statement: Actual Adj. Budget Estimated Budget

To assess and collect Expenditure Detail: 18-19 19-20 19-20 20-21

the property tax that Personnel Services

is due to the City of Salaries and Wages $ 217,567 $ 224,432 $ 224,432 $ 237,808

McAllen according to Employee Benefits 59,955 67,069 67,069 72,017

current year Property Supplies 6,031 7,000 7,000 8,000

Values and all other Other Services and Charges 812,065 856,341 856,341 895,947

taxes that may be due. Maintenance 29,829 25,800 25,800 29,307

Operations Subtotal 1,125,448 1,180,642 1,180,642 1,243,079

Capital Outlay 525 - - -

Total Expenditures $ 1,125,973 $ 1,180,642 $ 1,180,642 $ 1,243,079

PERSONNEL

Exempt 1 1 1 1

Non-Exempt 5 5 5 5

Part-Time - 1 - 1

Total Positions Authorized 6 7 6 7

Contact Us: MAJOR FY 20-21 GOALS

Rebecca Grimes 1) Continue working with Tax Attorneys to clean up our Delinquent Tax Roll by removing accounts due to Statutes of

Tax Assessor-Collector Limitations.

311 N. 15th Street

McAllen, TX 78501 2) Allow Staff who are not registered with TDLR to receive additional education provided by HCAD.

(956) 681-1330 3) Work with Management to possibly waive the Convenience Fee when paying with an echeck.

Description: Performance Measures

The tax office has two Actual Goal Estimated Goal

separate functions: FY 18-19 FY 19-20 FY 19-20 FY 20-21

Assessing - Applying Inputs:

the current tax rate to

the certified values Full Time Employees 6 6 6 6

from the Appraisal Department Expenditures $ 1,125,973 $ 1,180,642 $ 1,180,642 $ 1,243,079

District to calculate Outputs:

the current year levy. Revenues generated:

This levy is what the Current Tax Collections $ 40,882,073 $ 42,164,938 $ 42,539,400 $ 43,886,277

City Commission

approves during our Delinquent Tax Collections $ 1,109,953 $ 1,080,000 $ 1,013,164 $ 1,080,000

budget process. Tax Paid Due to Tax Suits $ 373,834 $ 275,000 $ 264,200 $ 275,000

Collections - Tax Levy $ 42,091,053 $ 43,469,008 $ 44,311,875 $ 45,714,872

Collecting the levy Tax Accounts 56,747 57,264 56,942 57,402

calculated for the

current year and any Effectiveness Measures:

delinquent taxes still Collection rate of current taxes 97% 98% 96% 97%

on the tax roll. The Dept expenditures as a % of tax levy 2.68% 2.72% 2.66% 2.72%

Tax Office is in the Efficiency Measures:

process of obtaining

preliminary values Accts handled per full time employee 14,539 14,316 14,685 14,700

from the Hidalgo Collections per full time employee $ 6,998,671 $ 7,207,490 $ 7,258,761 $ 7,494,380

County Appraisal Department expenditures per capita $ 7.55 $ 7.77 $ 7.80 $ 8.10

District to begin the

collection process for

the new tax year.

-47-