Page 126 - (DK) The Business Book

P. 126

124

EXECUTIVE OFFICERS

MUST BE FREE

FROM AVARICE

PROFIT BEFORE PERKS

IN CONTEXT

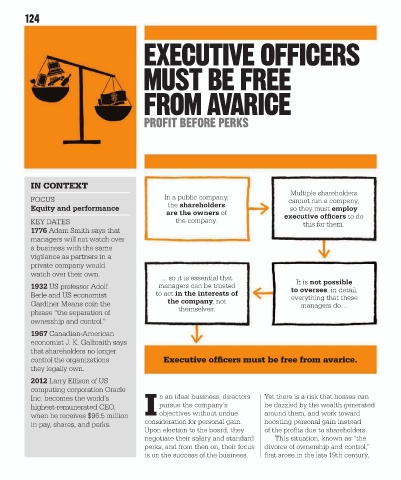

Multiple shareholders

FOCUS In a public company, cannot run a company,

the shareholders

Equity and performance so they must employ

are the owners of executive officers to do

KEY DATES the company.

this for them.

1776 Adam Smith says that

managers will not watch over

a business with the same

vigilance as partners in a

private company would

watch over their own.

... so it is essential that It is not possible

1932 US professor Adolf managers can be trusted to oversee, in detail,

Berle and US economist to act in the interests of everything that these

the company, not

Gardiner Means coin the managers do…

themselves.

phrase “the separation of

ownership and control.”

1967 Canadian-American

economist J. K. Galbraith says

that shareholders no longer

control the organizations Executive officers must be free from avarice.

they legally own.

2012 Larry Ellison of US

computing corporation Oracle

Inc. becomes the world’s n an ideal business, directors Yet there is a risk that bosses can

highest-remunerated CEO, pursue the company’s be dazzled by the wealth generated

I objectives without undue around them, and work toward

when he receives $96.5 million

consideration for personal gain. boosting personal gain instead

in pay, shares, and perks.

Upon election to the board, they of the profits due to shareholders.

negotiate their salary and standard This situation, known as “the

perks, and from then on, their focus divorce of ownership and control,”

is on the success of the business. first arose in the late 19th century,