Page 128 - (DK) The Business Book

P. 128

126

IF WEALTH IS PLACED

WHERE IT BEARS INTEREST,

IT COMES BACK TO YOU

REDOUBLED

INVESTMENT AND DIVIDENDS

fter calculating the year’s to shareholders that most businesses

IN CONTEXT profit, a company’s manage each year. It might amount

A directors can choose to a 3 percent return on the sum

FOCUS

whether to pay a dividend to invested, which would make it

Financial strategy

shareholders or reinvest the sum. comparable to the interest a saver

KEY DATES A dividend is the annual payment might receive from a bank deposit.

1288 The first recorded share

certificate is issued to the

Bishop of Vasteras in Sweden

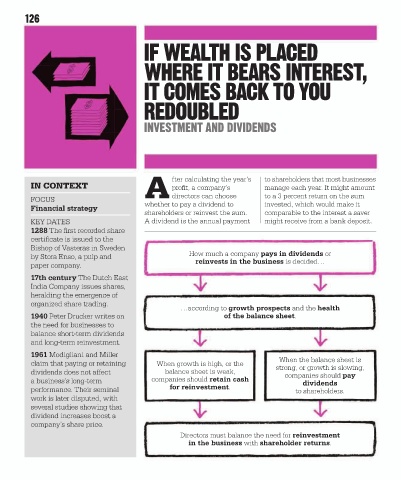

How much a company pays in dividends or

by Stora Enso, a pulp and

reinvests in the business is decided…

paper company.

17th century The Dutch East

India Company issues shares,

heralding the emergence of

organized share trading.

…according to growth prospects and the health

1940 Peter Drucker writes on of the balance sheet.

the need for businesses to

balance short-term dividends

and long-term reinvestment.

1961 Modigliani and Miller

When the balance sheet is

claim that paying or retaining When growth is high, or the strong, or growth is slowing,

dividends does not affect balance sheet is weak, companies should pay

a business’s long-term companies should retain cash dividends

performance. Their seminal for reinvestment. to shareholders.

work is later disputed, with

several studies showing that

dividend increases boost a

company’s share price.

Directors must balance the need for reinvestment

in the business with shareholder returns.