Page 130 - (DK) The Business Book

P. 130

128

BORROW SHORT,

LEND LONG

MAKING MONEY FROM MONEY

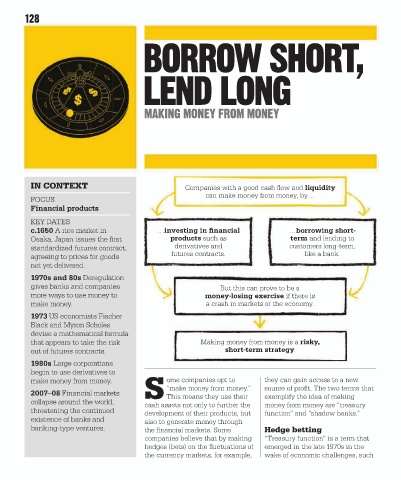

IN CONTEXT Companies with a good cash flow and liquidity

can make money from money, by…

FOCUS

Financial products

KEY DATES

c.1650 A rice market in …investing in financial …borrowing short-

Osaka, Japan issues the first products such as term and lending to

standardized futures contract, derivatives and customers long-term,

futures contracts. like a bank.

agreeing to prices for goods

not yet delivered.

1970s and 80s Deregulation

gives banks and companies But this can prove to be a

more ways to use money to money-losing exercise if there is

make money. a crash in markets or the economy.

1973 US economists Fischer

Black and Myron Scholes

devise a mathematical formula

that appears to take the risk Making money from money is a risky,

out of futures contracts. short-term strategy.

1980s Large corporations

begin to use derivatives to

make money from money. ome companies opt to they can gain access to a new

“make money from money.” source of profit. The two terms that

2007–08 Financial markets

S This means they use their exemplify the idea of making

collapse around the world,

cash assets not only to further the money from money are “treasury

threatening the continued

development of their products, but function” and ”shadow banks.”

existence of banks and also to generate money through

banking-type ventures. the financial markets. Some Hedge betting

companies believe that by making “Treasury function” is a term that

hedges (bets) on the fluctuations of emerged in the late 1970s in the

the currency markets, for example, wake of economic challenges, such