Page 166 - Post 1983 AD

P. 166

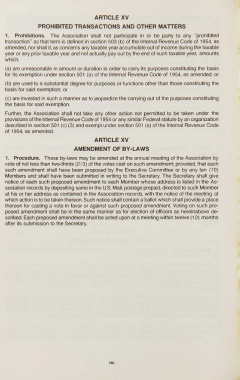

ARTICLE XV

PROHIBITED TRANSACTIONS AND OTHER MATTERS

1. Prohibitions. The Association shall not participate in or be party to any "prohibited

transaction" as that term is defined in section 503 (b) of the Internal Revenue Code of 1954, as

amended, nor shall it, as concerns any taxable year accumulate out of income during the taxable

year or any prior taxable year and not actually pay out by the end of such taxable year, amounts

which:

(a) are unreasonable in amount or duration in order to carry its purposes constituting the basis

for its exemption under section 501 (a) of the Internal Revenue Code of 1954, as amended; or

(b) are used to a substantial degree for purposes or functions other than those constituting the

basis for said exemption; or

(c) are invested in such a manner as to jeopardize the carrying out of the purposes constituting

the basis for said exemption.

Further, the Association shall not take any other action not permitted to be taken under the

provisions of the Internal Revenue Code of 1954 or any similar Federal statute by an organization

described in section 501 (c) (3) and exempt under section 501 (a) of the Internal Revenue Code

of 1954, as amended.

ARTICLE XV

AMENDMENT OF BY-LAWS

1. Procedure. These by-laws may be amended at the annual meeting of the Association by

vote of not less than two-thirds (2/3) of the votes cast on such amendment; provided, that each

such amendment shall have been proposed by the Executive Committee or by any ten (10)

Members and shall have been submitted in writing to the Secretary. The Secretary shall give

notice of each such proposed amendment to each Member whose address is listed in the As

sociation records by depositing same in the U.S. Mail, postage prepaid, directed to such Member

at his or her address as contained in the Association records, with the notice of the meeting at

which action is to be taken thereon. Such notice shall contain a ballot which shall provide a place

thereon for casting a vote in favor or against such proposed amendment. Voting on such pro

posed amendment shall be in the same manner as for election of officers as hereinabove de

scribed. Each proposed amendment shall be acted upon at a meeting within twelve (12) months

after its submission to the Secretary.

160