Page 313 - CRC_One Report 2021_EN

P. 313

Business Overview and Performance Corporate Governance Financial Statements Enclosure

(C) Employee Remuneration

The Company has in place a remuneration policy which is fair and competitive in the market as well as enhance

career stability and career advancement. The Company also arranges various benefits for its employees as required

by the law, for example social security, and other such as travel expenses, fuel and phone bills, employee/family

funeral allowance, hamper for employees when sickness, COVID-19 coverage, COVID-19 Insurance, master’s degree

scholarship for employees, employees ‘children scholarship, and staff discounts on Central Group’s products.

Moreover, there are voluntary benefits, for example company cooperative, cremation funds, and Employee Joint

Investment Program (EJIP). The program details are shown in Item 7.4.

The Company paid remuneration of approximately THB 17,600 million and THB 18,904 million to its employees

in 2020 and in the fiscal year ended 31 December 2021, respectively. Such remuneration was in the form of salaries,

bonuses, overtime pay, contributions to provident funds, and other remuneration as well as gratuities and provident

funds for employees in Thailand, contributions at the rate of 25 percent of the salaries of employees in Vietnam

to social security funds pursuant to Vietnamese laws for employee retirement funds and the establishment of

provident funds and gratuity funds for the employees in Italy pursuant to Italian laws.

(D) Provident Fund

For the selection of the Manager of the Provident Fund, the Company supports the Provident Fund Committee of

the Company in selecting a fund manager who abides by the Investment Governance Code (“I Code”) as practices for

fund management according to international approaches and manages investments with responsibility by taking into

account the environmental, social, and governance (“ESG“) dimensions, which will lead to efficient investment management

with consideration on returns and utmost benefits of the members of the Company’s provident fund in the long run.

In 2001, The Company and its employees established a provident fund pursuant to the “Provident Fund Act,

B.E. 2530 (1987), as amended, with the Siam Commercial Mutual Fund Management Securities Company Limited

as the fund manager, under the name of “CRC Group Provident Fund”.

Objectives of Establishment

1. To be employee welfare

2. To encourage employee savings

3. To insure the employees and their families in case of death, or removal from work, or retirement pursuant to

the Company’s regulations

Membership Eligibility

The Company’s employees at department manager (DM) level or equivalent who passed the probation

Criteria

1. The membership term starts from the first day of membership to the fund.

2. For the contributions of department manager (DM) level or equivalent to vice president (VP) level, 3 – 15 percent of

salaries of the members (employees) is contributed to the fund, and 3 percent of salaries of the employer (Company)

is contributed to the fund.

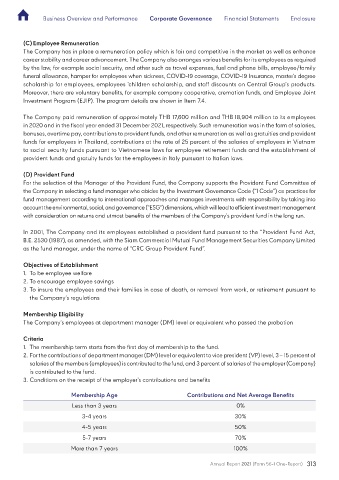

3. Conditions on the receipt of the employer’s contributions and benefits

Membership Age Contributions and Net Average Benefits

Less than 3 years 0%

3-4 years 30%

4-5 years 50%

5-7 years 70%

More than 7 years 100%

Annual Report 2021 (Form 56-1 One-Report) 313