Page 40 - mutual-fund-insight - Mar 2021_Neat

P. 40

FUND AXIS LONG TERM EQUITY FUND REGULAR DIRECT

ANALYST’S

CH ICE A sharp focus on quality

Launch look at its performance year increased it to more than 80 per cent

December 2009 after year over the last in the past few months. The

Fund manager Adecade is sufficient to remaining portfolio is invested in mid

Jinesh Gopani

explain why this fund is the biggest caps, with a very small allocation to

fund in the tax-saving category. The small caps. The portfolio is usually

fund has delivered top-quartile compact and has around 30–35 stocks.

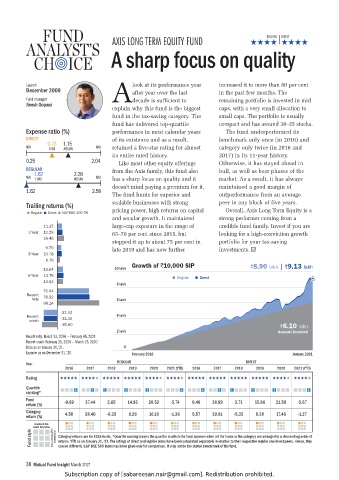

Expense ratio (%) performance in most calendar years The fund underperformed its

DIRECT of its existence and as a result, benchmark only once (in 2016) and

0.73 1.15

MIN FUND MEDIAN MAX retained a five-star rating for almost category only twice (in 2016 and

its entire rated history. 2017) in its 11-year history.

0.25 2.04 Like most other equity offerings Otherwise, it has stayed ahead in

REGULAR from the Axis family, this fund also bull, as well as bear phases of the

1.62 2.28

MIN FUND MEDIAN MAX has a sharp focus on quality and it market. As a result, it has always

doesn’t mind paying a premium for it. maintained a good margin of

1.62 2.58

The fund hunts for superior and outperformance from an average

Trailing returns (%) scalable businesses with strong peer in any block of five years.

Regular Direct S&P BSE 500 TRI pricing power, high returns on capital Overall, Axis Long Term Equity is a

and secular growth. It maintained strong performer coming from a

11.37 large-cap exposure in the range of credible fund family. Invest if you are

1-Year 12.28 65–70 per cent since 2015, but looking for a high-conviction growth

16.46

stepped it up to about 75 per cent in portfolio for your tax-saving

9.79 late 2019 and has now further investments.

3-Year 10.78

6.76

Growth of `10,000 SIP `8.90 lakh | `9.13 lakh

13.64 10 lakh

5-Year 14.76 Regular Direct

13.83

8 lakh

75.04

Recent 76.32

rally 6 lakh

99.14

-31.43

Recent -31.40 4 lakh

crash

-35.60 `6.10 lakh

2 lakh Amount invested

Recent rally: March 23, 2020 — February 05, 2021

Recent crash: February 25, 2020 — March 23, 2020

Data as on January 31, ‘21. 0

Expense as on December 31, ‘20. February 2016 January 2021

REGULAR DIRECT

Year

2016 2017 2018 2019 2020 2021 (YTD) 2016 2017 2018 2019 2020 2021 (YTD)

Rating

Quartile 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4

ranking*

Fund -0.69 37.44 2.65 14.83 20.52 -5.74 0.40 38.99 3.71 15.86 21.50 -5.67

return (%)

Category 4.58 38.40 -6.33 8.26 16.16 -1.36 5.57 39.81 -5.35 9.38 17.46 -1.27

return (%)

Investment style

Fund style Growth Blend Value Large Medium Small Capitalisation Category returns are for ELSS funds. *Quartile ranking means the quartile in which the fund appears when all the funds in the category are arranged in a descending order of

returns. YTD as on January 31, ’21. The ratings of direct and regular plans have been calculated separately in relation to their respective regular and direct peers. Hence, they

can be different. S&P BSE 500 index has been given only for comparison. It may not be the stated benchmark of the fund.

38 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.