Page 66 - mutual-fund-insight - Mar 2021_Neat

P. 66

For more on funds, visit www.valueresearchonline.com

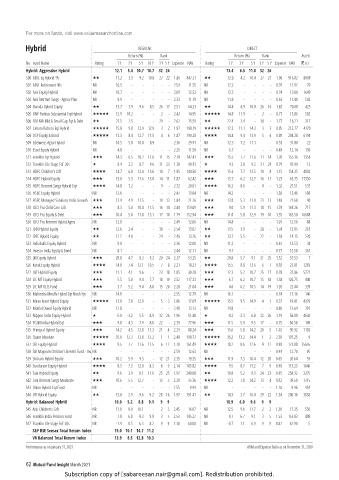

Hybrid REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Hybrid: Aggressive Hybrid 12.1 5.4 10.7 10.7 32 26 13.4 6.5 11.8 32 26

500 ABSL Eq Hybrid ‘95 11.2 3.3 9.2 10.8 27 22 1.86 847.51 12.0 4.2 10.4 27 21 1.06 916.82 8008

501 ABSL Retirement 40s NR 10.5 - - - - - 2.54 11.55 NR 12.3 - - - - 0.97 11.91 79

502 Axis Equity Hybrid NR 10.7 - - - - - 2.09 12.52 NR 12.3 - - - - 0.74 13.00 1649

503 Axis Retrmnt Svngs - Agrssv Plan NR 9.9 - - - - - 2.33 11.19 NR 11.8 - - - - 0.63 11.40 542

504 Baroda Hybrid Equity 13.7 3.9 9.6 8.5 26 17 2.51 64.23 14.4 4.9 10.8 26 16 1.83 70.00 425

505 BNP Paribas Substantial Eqt Hybrid 12.9 10.2 - - 2 - 2.42 14.95 14.8 11.9 - 2 - 0.77 15.86 502

506 BOI AXA Mid & Small Cap Eqt & Debt 21.5 2.5 - - 29 - 2.62 15.59 22.4 3.4 - 30 - 1.77 16.21 317

507 Canara Robeco Eqt Hybrid 15.8 9.8 12.9 12.9 3 2 1.97 198.19 17.2 11.1 14.3 3 3 0.85 212.77 4170

508 DSP Equity & Bond 13.3 8.4 12.7 11.5 4 6 1.87 190.28 14.4 9.4 13.9 5 6 0.89 204.28 6194

509 Edelweiss Agrsv Hybrid NR 10.5 5.8 10.0 8.9 - - 2.36 29.91 NR 12.3 7.2 11.1 - - 0.53 31.80 22

510 Essel Equity Hybrid NR 4.8 - - - - - 2.35 11.58 NR 6.7 - - - - 0.48 12.14 130

511 Franklin Eqt Hybrid 14.3 6.5 10.2 11.6 11 15 2.19 142.41 15.5 7.7 11.6 11 14 1.20 155.36 1356

512 Franklin Life Stage FoF 20s 8.4 2.2 8.7 9.6 31 23 1.38 90.43 9.3 2.8 9.2 31 24 0.79 93.99 12

513 HDFC Children’s Gift 14.7 6.8 12.4 13.6 10 7 1.95 144.50 15.6 7.7 13.5 10 8 1.15 154.35 4002

514 HDFC Hybrid Equity 13.0 5.3 11.6 13.0 14 11 1.87 62.42 13.7 6.2 12.7 16 11 1.23 65.75 17350

515 HDFC Retrmnt Svngs Hybrid Eqt 14.8 7.2 - - 9 - 2.72 20.01 16.2 8.6 - 8 - 1.32 21.51 531

516 HSBC Equity Hybrid NR 12.6 - - - - - 2.47 13.04 NR 14.2 - - - - 1.02 13.46 508

517 HSBC Managed Solutions India Growth 13.4 4.9 11.5 - 19 13 1.84 21.26 13.8 5.3 11.8 23 13 1.48 21.68 40

518 ICICI Pru Child Care Gift 8.3 5.0 10.4 11.5 16 14 2.44 159.09 9.0 5.9 11.3 18 15 1.79 169.26 717

519 ICICI Pru Equity & Debt 10.4 5.0 11.8 13.1 17 10 1.79 152.94 11.0 5.8 12.9 19 10 1.35 165.50 16688

520 ICICI Pru Retrmnt Hybrid Agrsv NR 12.8 - - - - - 2.49 12.06 NR 14.8 - - - - 1.01 12.50 88

521 IDBI Hybrid Equity 12.6 2.4 - - 30 - 2.54 13.07 13.5 3.9 - 28 - 1.74 13.95 218

522 IDFC Hybrid Equity 12.2 4.0 - - 24 - 2.46 13.26 13.7 5.5 - 22 - 1.18 14.15 520

523 Indiabulls Equity Hybrid NR 9.0 - - - - - 2.36 12.00 NR 11.2 - - - - 0.61 12.53 34

524 Invesco India Equity & Bond NR 8.1 - - - - - 2.44 12.11 NR 9.7 - - - - 0.77 12.58 367

525 JM Equity Hybrid 28.8 4.7 8.3 9.2 20 24 2.37 53.25 29.8 5.7 9.1 21 25 1.52 57.53 7

526 Kotak Equity Hybrid 14.0 7.4 12.1 10.5 7 8 2.21 18.23 15.5 8.8 13.6 6 7 0.92 21.01 1283

527 L&T Hybrid Equity 11.1 4.1 9.6 - 23 18 1.85 30.28 12.3 5.2 10.7 25 17 0.78 32.86 5721

528 LIC MF Equity Hybrid 5.5 5.0 9.4 7.7 18 19 2.52 117.33 6.7 6.2 10.7 15 18 1.38 126.75 440

529 LIC MF ULIS Fund 3.7 5.2 9.4 8.0 15 20 2.28 21.04 4.6 6.2 10.5 14 19 1.20 22.44 339

530 Mahindra Mnulfe Hybrd Eqt Nivsh Yjn NR 14.0 - - - - - 2.55 12.79 NR 16.1 - - - - 0.74 13.16 146

531 Mirae Asset Hybrid Equity 13.8 7.8 12.9 - 5 3 1.86 17.69 15.5 9.5 14.9 4 1 0.37 19.41 4379

532 Motilal Oswal Equity Hybrid NR 12.8 - - - - - 2.48 13.13 NR 14.8 - - - - 0.88 13.64 391

533 Nippon India Equity Hybrid -5.0 -3.2 5.5 8.9 32 26 1.96 51.48 -4.2 -2.3 6.8 32 26 1.19 56.00 4636

534 PGIM India Hybrid Eqt 9.8 4.3 7.9 8.0 22 - 2.39 77.96 11.5 5.9 9.5 17 - 0.75 86.58 109

535 Principal Hybrid Equity 14.2 4.5 12.8 11.3 21 4 2.23 88.24 15.6 5.8 14.2 20 5 1.02 95.92 1102

536 Quant Absolute 35.0 12.3 13.8 12.2 1 1 2.48 190.73 36.2 13.3 14.4 1 2 2.38 197.25 9

537 SBI Equity Hybrid 9.5 7.7 11.6 12.5 6 12 1.70 161.49 10.2 8.6 12.6 9 12 0.98 173.00 35655

538 SBI Magnum Children’s Benefit Fund - Inv NR - - - - - - 2.59 12.63 NR - - - - - 0.94 12.70 95

539 Shriram Hybrid Equity 10.2 5.9 9.3 - 12 21 2.35 19.35 11.9 7.3 10.4 12 20 0.65 20.64 59

540 Sundaram Equity Hybrid 8.3 7.3 12.0 8.3 8 9 2.14 105.82 9.5 8.7 13.2 7 9 0.90 113.23 1646

541 Tata Hybrid Equity 9.6 3.9 8.1 11.6 25 25 1.97 240.08 10.8 5.2 9.3 24 23 0.95 258.32 3375

542 Tata Retrmnt Svngs Moderate 10.6 5.5 12.7 - 13 5 2.20 35.36 12.2 7.0 14.2 13 4 0.82 39.50 1315

543 Union Hybrid Eqt Fund NR - - - - - - 2.55 9.94 NR - - - - - 1.28 9.96 454

544 UTI Hybrid Equity 13.4 2.9 9.6 9.2 28 16 1.97 191.41 14.3 3.7 10.4 29 22 1.34 200.16 3838

Hybrid: Balanced Hybrid 10.0 5.2 8.8 9.1 9 9 10.9 6.0 9.6 9 9

545 Axis Children’s Gift NR 11.0 8.0 10.1 - 2 3 2.45 16.07 NR 12.5 9.6 11.7 2 2 1.30 17.35 556

546 Franklin India Pension Fund NR 7.8 6.0 8.3 9.8 3 5 2.53 145.27 NR 8.7 6.7 9.1 3 5 1.53 153.83 449

547 Franklin Life Stage FoF 30s NR -1.4 0.5 6.3 8.2 9 9 1.38 60.00 NR -0.7 1.1 6.9 9 9 0.82 62.90 5

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

VR Balanced Total Return Index 13.9 8.5 12.8 10.3

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

62 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.