Page 76 - mutual-fund-insight - Mar 2021_Neat

P. 76

For more on funds, visit www.valueresearchonline.com

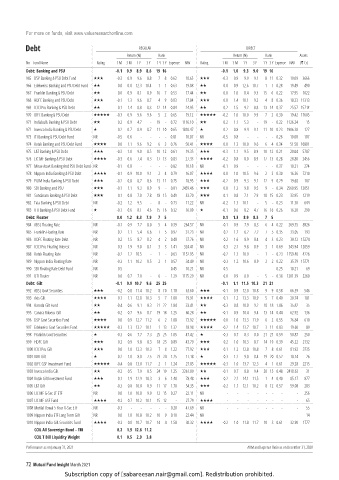

Debt REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV (` Cr)

Debt: Banking and PSU -0.1 0.9 8.9 8.6 19 16 -0.1 1.0 9.3 9.0 19 16

965 DSP Banking & PSU Debt Fund -0.3 0.9 9.6 8.8 7 8 0.62 18.65 -0.3 0.9 9.9 9.1 8 11 0.32 19.09 3666

966 Edelweiss Banking and PSU Debt Fund 0.0 0.8 12.3 10.4 1 1 0.63 19.08 0.0 0.9 12.6 10.7 1 1 0.28 19.49 490

967 Franklin Banking & PSU Debt 0.0 0.9 8.1 8.9 16 7 0.53 17.44 0.0 1.0 8.4 9.3 15 6 0.22 17.95 1022

968 HDFC Banking and PSU Debt -0.1 1.3 9.6 8.7 4 9 0.83 17.84 0.0 1.4 10.1 9.2 4 8 0.36 18.23 11313

969 ICICI Pru Banking & PSU Debt 0.1 1.4 8.8 8.3 12 14 0.84 24.95 0.2 1.5 9.2 8.8 13 14 0.37 25.57 15714

970 IDFC Banking & PSU Debt -0.3 0.9 9.6 9.6 5 2 0.65 19.12 -0.2 1.0 10.0 9.9 7 2 0.30 19.42 17685

971 Indiabulls Banking & PSU Debt 0.2 0.9 4.7 - 19 - 0.72 1116.10 0.2 1.1 5.3 - 19 - 0.22 1126.24 15

972 Invesco India Banking & PSU Debt 0.2 0.7 8.9 8.7 11 10 0.65 1810.47 0.2 0.8 9.4 9.1 11 10 0.23 1906.38 127

973 ITI Banking & PSU Debt Fund NR -0.5 0.6 - - - - 0.81 10.07 NR -0.5 0.8 - - - - 0.26 10.08 107

974 Kotak Banking and PSU Debt Fund 0.0 1.1 9.6 9.2 6 3 0.76 50.41 0.0 1.3 10.0 9.6 6 4 0.34 51.58 10801

975 L&T Banking & PSU Debt -0.3 1.0 9.0 8.5 10 12 0.61 19.35 -0.3 1.1 9.5 8.9 10 12 0.21 20.04 5707

976 LIC MF Banking & PSU Debt -0.3 0.6 7.4 8.3 17 13 0.83 27.33 -0.2 0.8 8.0 8.9 17 13 0.28 28.80 2456

977 Mirae Asset Banking And PSU Debt Fund NR -0.1 0.8 - - - - 0.82 10.18 NR -0.1 0.9 - - - - 0.37 10.21 274

978 Nippon India Banking & PSU Debt -0.1 0.9 10.0 9.1 2 4 0.79 16.07 0.0 1.0 10.5 9.6 2 3 0.30 16.36 7210

979 PGIM India Banking & PSU Debt -0.2 0.8 8.7 8.6 13 11 0.75 18.95 -0.2 0.9 9.3 9.1 12 9 0.29 19.68 107

980 SBI Banking and PSU -0.1 1.1 9.3 8.9 9 - 0.81 2459.46 0.0 1.3 9.8 9.5 9 - 0.34 2560.95 12051

981 Sundaram Banking & PSU Debt 0.1 0.8 7.0 7.8 18 15 0.49 33.70 0.1 0.8 7.1 7.9 18 15 0.23 33.95 1219

982 Tata Banking & PSU Debt NR -0.2 1.2 9.5 - 8 - 0.73 11.22 NR -0.2 1.3 10.1 - 5 - 0.23 11.30 644

983 UTI Banking & PSU Debt Fund -0.1 0.6 8.1 4.6 15 16 0.32 16.09 -0.1 0.6 8.2 4.7 16 16 0.26 16.20 290

Debt: Floater 0.0 1.2 8.3 7.9 7 5 0.1 1.3 8.9 8.3 7 5

984 ABSL Floating Rate NR -0.1 0.9 7.7 8.0 5 4 0.39 264.57 NR -0.1 0.9 7.9 8.3 6 4 0.22 269.35 8926

985 Franklin Floating Rate NR 0.2 1.1 5.4 6.6 7 5 0.97 31.23 NR 0.2 1.2 6.2 7.2 7 5 0.35 33.05 193

986 HDFC Floating Rate Debt NR 0.2 1.5 8.7 8.2 4 2 0.48 37.76 NR 0.2 1.6 8.9 8.4 4 3 0.23 38.12 15274

987 ICICI Pru Floating Interest NR 0.3 1.9 9.0 8.1 3 3 1.41 324.41 NR 0.3 2.1 9.8 8.9 3 1 0.69 343.94 12059

988 Kotak Floating Rate NR -0.2 1.2 10.5 - 1 - 0.63 1152.95 NR -0.2 1.3 10.9 - 1 - 0.23 1159.40 4226

989 Nippon India Floating Rate NR -0.3 1.1 10.2 8.5 2 1 0.57 34.49 NR -0.3 1.2 10.6 8.9 2 2 0.22 35.79 15771

990 SBI Floating Rate Debt Fund NR 0.5 - - - - - 0.45 10.21 NR 0.5 - - - - - 0.25 10.21 69

991 UTI Floater NR 0.0 0.7 7.0 - 6 - 1.29 1175.29 NR 0.0 0.9 8.0 - 5 - 0.38 1201.39 2260

Debt: Gilt -0.1 0.9 10.7 9.6 25 25 -0.1 1.1 11.5 10.3 21 21

992 ABSL Govt Securities -0.2 0.8 11.4 10.2 8 10 1.18 63.60 -0.1 0.9 12.0 10.8 9 9 0.58 66.39 546

993 Axis Gilt 0.1 1.1 12.8 10.3 5 7 1.00 19.91 0.1 1.2 13.3 10.9 5 7 0.40 20.74 181

994 Baroda Gilt Fund -0.4 0.6 9.1 8.3 21 22 1.84 33.41 -0.3 0.8 10.0 9.2 18 18 1.06 35.82 35

995 Canara Robeco Gilt -0.2 0.7 9.6 8.7 19 18 1.25 60.28 -0.1 0.9 10.4 9.4 13 14 0.44 62.92 136

996 DSP Govt Securities Fund 0.0 0.9 12.7 11.2 6 2 1.08 73.92 0.0 1.0 13.3 11.9 6 2 0.55 76.84 610

997 Edelweiss Govt Securities Fund -0.3 1.3 13.2 10.1 1 13 1.32 18.98 -0.2 1.4 13.7 10.7 3 11 0.83 19.60 89

998 Franklin Govt Securities -0.3 0.6 7.7 7.3 25 25 1.05 47.42 -0.3 0.7 8.3 8.0 21 21 0.59 50.87 250

999 HDFC Gilt -0.2 0.9 9.8 8.3 18 23 0.89 43.79 -0.2 1.0 10.3 8.7 14 19 0.39 45.22 2132

1000 ICICI Pru Gilt 0.0 1.0 12.3 10.3 7 8 1.22 77.92 0.1 1.2 12.8 10.8 7 8 0.61 81.92 3735

1001 IDBI Gilt 0.2 1.0 8.0 7.5 23 24 1.25 17.18 0.3 1.2 9.0 8.4 19 20 0.52 18.14 26

1002 IDFC GSF Investment Fund -0.4 0.8 13.0 11.7 2 1 1.24 27.85 -0.3 1.0 13.7 12.3 4 1 0.61 29.28 2215

1003 Invesco India Gilt -0.2 0.5 7.9 8.5 24 19 1.25 2261.89 -0.1 0.7 8.8 9.4 20 15 0.48 2418.63 31

1004 Kotak Gilt Investment Fund 0.1 1.9 12.9 10.3 3 6 1.40 78.48 0.2 2.2 14.1 11.5 1 4 0.40 85.17 877

1005 L&T Gilt -0.3 0.8 10.8 8.9 11 17 1.70 54.35 -0.2 1.1 12.1 10.2 8 12 0.57 59.08 283

1006 LIC MF G-Sec LT ETF NR 0.0 1.0 10.8 9.9 12 15 0.27 22.11 NR - - - - - - - - 256

1007 LIC MF GSF Fund -0.2 0.7 10.2 10.1 15 12 - 27.79 - - - - - - - - 65

1008 Motilal Oswal 5 Year G-Sec ETF NR -0.3 - - - - - 0.20 47.69 NR - - - - - - - - 55

1009 Nippon India ETF Long Term Gilt NR 0.0 1.0 10.8 10.2 10 9 0.10 22.44 NR - - - - - - - - 14

1010 Nippon India Gilt Securities Fund -0.3 0.8 10.7 10.7 14 4 1.58 30.32 -0.2 1.0 11.8 11.7 10 3 0.61 32.90 1777

CCIL All Sovereign Bond - TRI 0.2 1.9 12.6 11.2

CCIL T Bill Liquidity Weight 0.1 0.5 2.9 3.8

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

72 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.