Page 75 - mutual-fund-insight - Mar 2021_Neat

P. 75

For more on funds, visit www.valueresearchonline.com

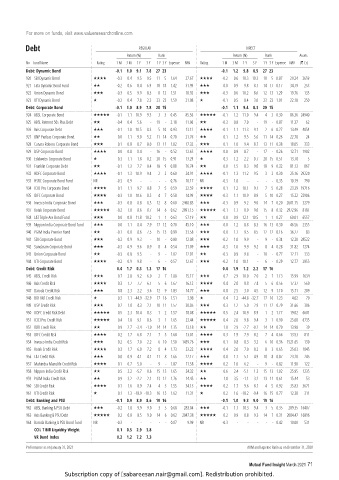

Debt REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV (` Cr)

Debt: Dynamic Bond -0.1 1.0 9.1 7.8 27 23 -0.1 1.2 9.8 8.5 27 23

920 SBI Dynamic Bond -0.3 0.4 9.5 9.5 11 5 1.64 27.67 -0.2 0.6 10.3 10.3 10 5 0.87 29.24 2659

921 Tata Dynamic Bond Fund -0.2 0.6 8.4 6.9 18 18 1.42 31.99 0.0 0.9 9.8 8.1 14 17 0.17 34.79 253

922 Union Dynamic Bond -0.3 0.5 9.9 8.3 8 12 1.51 18.92 -0.3 0.6 10.2 8.6 12 13 1.29 19.76 135

923 UTI Dynamic Bond -0.2 0.4 7.8 2.3 23 23 1.59 21.08 -0.1 0.5 8.4 3.0 23 23 1.01 22.18 250

Debt: Corporate Bond -0.1 1.0 8.9 7.8 20 15 -0.1 1.1 9.4 8.3 20 15

924 ABSL Corporate Bond -0.1 1.1 10.9 9.3 3 3 0.45 85.56 -0.1 1.2 11.0 9.4 4 3 0.30 86.36 24940

925 ABSL Retrmnt 50s Plus Debt -0.4 0.4 5.6 - 19 - 2.18 11.06 -0.3 0.8 7.0 - 19 - 0.87 11.37 62

926 Axis Corporate Debt -0.1 1.0 10.5 8.3 5 10 0.93 13.12 -0.1 1.1 11.3 9.1 2 6 0.27 13.49 4054

927 BNP Paribas Corporate Bond 0.0 1.1 9.0 5.2 11 14 0.70 21.76 0.1 1.2 9.5 5.6 11 14 0.26 22.70 24

928 Canara Robeco Corporate Bond -0.1 0.8 8.7 8.0 13 11 1.02 17.32 -0.1 1.0 9.4 8.7 13 11 0.38 18.05 333

929 DSP Corporate Bond 0.0 0.8 8.4 - 16 - 0.52 12.63 0.0 0.9 8.7 - 17 - 0.26 12.71 1902

930 Edelweiss Corporate Bond 0.3 1.1 1.8 0.2 20 15 0.91 13.29 0.3 1.2 2.2 0.7 20 15 0.51 13.70 5

931 Franklin Corporate Debt -0.1 1.3 7.7 8.4 18 9 0.88 76.74 0.0 1.5 8.3 9.0 18 9 0.32 81.13 867

932 HDFC Corporate Bond -0.1 1.3 10.9 9.4 2 2 0.60 24.91 -0.1 1.3 11.2 9.5 3 2 0.30 25.16 29220

933 HSBC Corporate Bond Fund NR -0.3 0.9 - - - - 0.76 10.17 NR -0.3 1.0 - - - - 0.35 10.19 790

934 ICICI Pru Corporate Bond 0.1 1.1 9.7 8.8 7 5 0.59 22.59 0.1 1.2 10.1 9.1 7 5 0.28 23.39 19716

935 IDFC Corporate Bond -0.3 1.0 10.6 8.5 4 7 0.58 14.99 -0.3 1.1 10.9 8.9 5 10 0.27 15.22 22906

936 Invesco India Corporate Bond -0.3 0.8 8.8 8.5 12 8 0.60 2468.83 -0.3 0.9 9.2 9.0 14 7 0.20 2601.15 3279

937 Kotak Corporate Bond -0.2 1.0 8.6 8.7 14 6 0.62 2891.15 -0.1 1.1 8.9 9.0 15 8 0.32 2972.96 8181

938 L&T Triple Ace Bond Fund 0.0 0.8 11.8 10.2 1 1 0.63 57.19 0.0 0.9 12.1 10.5 1 1 0.27 60.01 6557

939 Nippon India Corporate Bond Fund 0.0 1.1 8.4 7.9 17 12 0.70 45.10 0.0 1.2 8.8 8.3 16 13 0.30 46.56 2355

940 PGIM India Premier Bond -0.1 0.8 8.6 7.5 15 13 0.99 33.58 0.0 1.1 9.5 8.5 12 12 0.16 36.27 83

941 SBI Corporate Bond -0.2 0.9 9.3 - 10 - 0.80 12.08 -0.2 1.0 9.9 - 9 - 0.34 12.20 28522

942 Sundaram Corporate Bond -0.3 0.9 9.6 8.9 8 4 0.54 31.09 -0.3 1.0 9.9 9.2 8 4 0.28 31.82 1274

943 Union Corporate Bond -0.3 0.8 9.5 - 9 - 1.02 12.01 -0.3 0.9 9.8 - 10 - 0.77 12.11 333

944 UTI Corporate Bond -0.2 0.9 9.8 - 6 - 0.57 12.67 -0.2 1.0 10.1 - 6 - 0.29 12.77 2855

Debt: Credit Risk 0.4 1.7 0.3 1.3 17 16 0.4 1.9 1.2 2.2 17 16

945 ABSL Credit Risk 0.7 2.8 9.2 6.0 2 7 1.88 15.17 0.7 2.9 10.0 7.0 2 7 1.13 15.99 1634

946 Axis Credit Risk 0.3 1.7 7.7 6.1 5 6 1.67 16.12 0.4 2.0 8.8 7.4 5 6 0.56 17.37 560

947 Baroda Credit Risk 0.8 2.3 2.2 3.6 12 9 1.83 14.77 0.8 2.5 3.0 4.5 12 9 1.10 15.71 209

948 BOI AXA Credit Risk 0.3 1.1 -44.9 -32.9 17 16 1.51 3.98 0.4 1.2 -44.8 -32.7 17 16 1.23 4.02 70

949 DSP Credit Risk 0.2 1.0 4.3 2.1 10 11 1.57 30.05 0.3 1.2 5.0 2.9 11 12 0.79 31.66 306

950 HDFC Credit Risk Debt 0.5 2.3 10.4 8.3 1 2 1.57 18.08 0.5 2.4 10.9 8.9 1 2 1.17 19.02 6601

951 ICICI Pru Credit Risk 0.4 1.8 9.1 8.6 3 1 1.65 23.44 0.4 2.0 9.8 9.4 3 1 0.90 25.08 6735

952 IDBI Credit Risk 0.9 2.7 -3.4 -1.0 14 14 1.35 13.18 1.0 2.9 -2.7 -0.2 14 14 0.70 13.98 39

953 IDFC Credit Risk 0.2 1.7 6.8 7.1 7 5 1.68 13.01 0.3 1.9 7.9 8.2 7 4 0.66 13.53 811

954 Invesco India Credit Risk -0.2 0.5 7.0 2.2 6 10 1.50 1439.76 -0.1 0.8 8.3 3.2 6 10 0.36 1521.65 130

955 Kotak Credit Risk 0.3 1.7 6.0 7.2 8 4 1.73 23.22 0.4 2.0 7.0 8.2 8 3 0.65 25.03 1845

956 L&T Credit Risk 0.0 0.9 4.1 4.1 11 8 1.66 22.17 0.0 1.1 5.1 4.9 10 8 0.87 23.20 245

957 Mahindra Manulife Credit Risk 0.1 0.7 5.0 - 9 - 1.87 11.58 0.2 1.0 6.2 - 9 - 0.82 11.90 122

958 Nippon India Credit Risk 0.5 2.2 -5.7 0.6 15 13 1.65 24.32 0.6 2.4 -5.1 1.3 15 13 1.02 25.95 1235

959 PGIM India Credit Risk 0.9 3.2 -2.2 2.1 13 12 1.76 14.45 1.0 3.5 -1.1 3.2 13 11 0.61 15.44 53

960 SBI Credit Risk 0.1 1.6 8.9 7.4 4 3 1.55 34.13 0.2 1.7 9.6 8.1 4 5 0.92 35.83 3671

961 UTI Credit Risk 0.1 1.3 -18.9 -10.3 16 15 1.62 11.31 0.2 1.6 -18.2 -9.4 16 15 0.77 12.38 311

Debt: Banking and PSU -0.1 0.9 8.9 8.6 19 16 -0.1 1.0 9.3 9.0 19 16

962 ABSL Banking & PSU Debt -0.2 1.0 9.9 9.0 3 5 0.68 283.04 -0.1 1.1 10.3 9.4 3 5 0.35 289.35 16407

963 Axis Banking & PSU Debt -0.2 0.8 8.5 9.0 14 6 0.62 2047.38 -0.2 0.9 8.8 9.3 14 7 0.31 2084.47 16896

964 Baroda Banking & PSU Bond Fund NR -0.3 - - - - - 0.87 9.99 NR -0.3 - - - - - 0.42 10.00 531

CCIL T Bill Liquidity Weight 0.1 0.5 2.9 3.8

VR Bond Index 0.2 1.2 7.2 7.3

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 71

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.