Page 77 - mutual-fund-insight - Mar 2021_Neat

P. 77

For more on funds, visit www.valueresearchonline.com

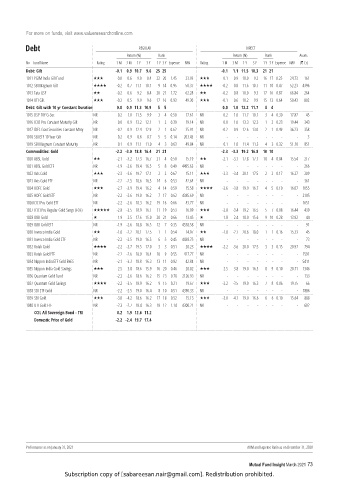

Debt REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV (` Cr)

Debt: Gilt -0.1 0.9 10.7 9.6 25 25 -0.1 1.1 11.5 10.3 21 21

1011 PGIM India Gilt Fund 0.0 0.6 9.0 8.4 22 20 1.45 23.93 0.1 0.9 10.0 9.2 16 17 0.25 24.73 161

1012 SBI Magnum Gilt -0.2 0.7 11.1 10.1 9 14 0.95 50.37 -0.2 0.8 11.6 10.7 11 10 0.47 52.23 4396

1013 Tata GSF -0.2 0.6 9.2 8.4 20 21 1.72 62.28 -0.2 0.8 10.0 9.3 17 16 0.87 66.84 264

1014 UTI Gilt -0.2 0.5 9.9 9.6 17 16 0.93 49.30 -0.1 0.6 10.2 9.9 15 13 0.64 50.43 802

Debt: Gilt with 10 yr Constant Duration 0.0 0.9 11.3 10.9 5 5 0.0 1.0 12.2 11.7 4 4

1015 DSP 10Y G-Sec NR 0.2 1.0 11.5 9.9 3 4 0.50 17.61 NR 0.2 1.0 11.7 10.1 3 4 0.30 17.87 45

1016 ICICI Pru Constant Maturity Gilt NR 0.0 0.9 13.2 12.1 1 2 0.39 19.14 NR 0.0 1.0 13.3 12.3 1 2 0.23 19.44 343

1017 IDFC Govt Securities Constant Mtrty NR -0.2 0.9 12.4 12.9 2 1 0.62 35.91 NR -0.2 0.9 12.6 13.0 2 1 0.49 36.23 358

1018 SBI ETF 10 Year Gilt NR 0.2 0.9 8.6 8.7 5 5 0.14 203.43 NR - - - - - - - - 3

1019 SBI Magnum Constant Maturity NR -0.1 0.9 11.1 11.0 4 3 0.63 49.84 NR -0.1 1.0 11.4 11.3 4 3 0.32 51.10 851

Commodities: Gold -2.2 -3.0 18.8 16.4 21 21 -2.3 -3.3 19.2 16.8 10 10

1020 ABSL Gold -2.1 -3.2 17.3 16.7 21 4 0.50 15.19 -2.1 -3.1 17.8 17.1 10 4 0.04 15.54 217

1021 ABSL Gold ETF NR -1.9 -2.6 19.4 16.5 5 8 0.49 4495.63 NR - - - - - - - - 266

1022 Axis Gold -2.3 -3.6 19.7 17.1 2 2 0.67 15.11 -2.3 -3.4 20.1 17.5 2 2 0.17 16.27 209

1023 Axis Gold ETF NR -2.2 -2.5 18.6 16.5 14 6 0.53 42.64 NR - - - - - - - - 361

1024 HDFC Gold -2.7 -3.9 19.4 16.2 4 14 0.59 15.58 -2.6 -3.8 19.9 16.7 4 5 0.10 16.07 1055

1025 HDFC Gold ETF NR -2.2 -2.6 19.0 16.2 7 17 0.62 4385.69 NR - - - - - - - - 2105

1026I CICI Pru Gold ETF NR -2.2 -2.6 18.3 16.2 19 16 0.66 43.77 NR - - - - - - - - 1651

1027 ICICI Pru Regular Gold Svngs (FOF) -2.8 -3.5 18.9 16.1 11 19 0.53 16.09 -2.8 -3.4 19.2 16.5 5 7 0.08 16.44 439

1028 IDBI Gold -1.9 -2.5 17.6 15.0 20 21 0.66 13.45 -1.8 -2.4 18.0 15.6 9 10 0.28 13.92 44

1029 IDBI Gold ETF NR -1.9 -2.6 18.8 16.5 12 7 0.35 4538.58 NR - - - - - - - - 91

1030 Invesco India Gold -1.0 -2.2 20.1 17.5 1 1 0.54 14.97 -1.0 -2.1 20.6 18.0 1 1 0.16 15.33 45

1031 Invesco India Gold ETF NR -2.2 -2.5 19.0 16.5 6 5 0.45 4438.75 NR - - - - - - - - 73

1032 Kotak Gold -2.2 -3.7 19.5 17.0 3 3 0.51 20.23 -2.2 -3.6 20.0 17.5 3 3 0.15 20.97 794

1033 Kotak Gold ETF NR -2.2 -2.6 18.9 16.4 10 9 0.55 427.77 NR - - - - - - - - 1591

1034 Nippon India ETF Gold BeES NR -2.1 -3.3 18.8 16.3 13 11 0.82 42.84 NR - - - - - - - - 5411

1035 Nippon India Gold Savings -2.5 -3.8 18.6 15.9 16 20 0.46 20.02 -2.5 -3.8 19.0 16.3 8 9 0.10 20.71 1346

1036 Quantum Gold Fund NR -2.2 -2.6 18.6 16.2 15 13 0.78 2126.93 NR - - - - - - - - 133

1037 Quantum Gold Savings -2.2 -3.5 18.9 16.2 9 15 0.21 19.67 -2.2 -3.5 19.0 16.3 7 8 0.06 19.75 66

1038 SBI ETF Gold NR -2.2 -2.5 19.0 16.4 8 10 0.51 4390.33 NR - - - - - - - - 1886

1039 SBI Gold -3.0 -4.2 18.6 16.2 17 18 0.52 15.13 -3.0 -4.1 19.0 16.6 6 6 0.10 15.64 888

1040 UTI Gold ETF NR -2.3 -2.7 18.4 16.3 18 12 1.14 4300.21 NR - - - - - - - - 602

CCIL All Sovereign Bond - TRI 0.2 1.9 12.6 11.2

Domestic Price of Gold -2.2 -2.4 19.7 17.4

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 73

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.