Page 1208 - How to Make Money in Stocks Trilogy

P. 1208

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 191

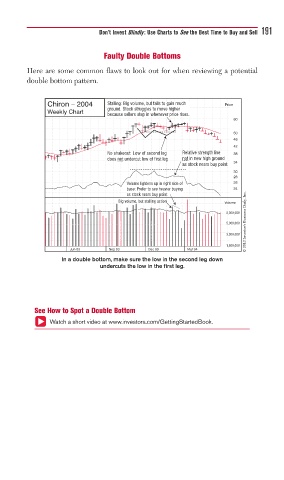

Faulty Double Bottoms

Here are some common flaws to look out for when reviewing a potential

double bottom pattern.

Chiron – 2004 Stalling: Big volume, but fails to gain much Price

ground. Stock struggles to move higher

Weekly Chart

because sellers step in whenever price rises.

60

50

46

42

No shakeout: Low of second leg Relative strength line 38

does not undercut low of first leg not in new high ground

as stock nears buy point 34

30

28

Volume lightens up in right side of 26

base: Prefer to see heavier buying 24

© 2013 Investor’s Business Daily, Inc.

as stock nears buy point

Big volume, but stalling action

Volume

8,000,000

5,000,000

3,000,000

1,800,000

Jun 03 Sep 03 Dec 03 Mar 04

In a double bottom, make sure the low in the second leg down

undercuts the low in the first leg.

See How to Spot a Double Bottom

Watch a short video at www.investors.com/GettingStartedBook.