Page 1212 - How to Make Money in Stocks Trilogy

P. 1212

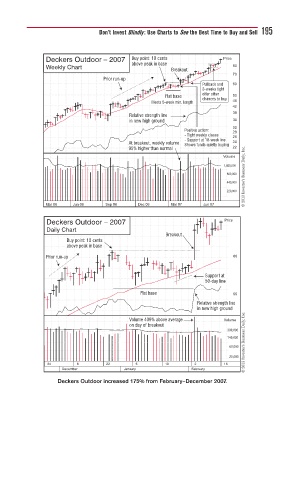

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 195

Deckers Outdoor – 2007 Buy point: 10 cents Price

above peak in base

Weekly Chart 80

Breakout

70

Prior run-up

Pullback and 60

3-weeks tight

offer other

Flat base 50

chances to buy

Meets 5-week min. length 46

42

38

Relative strength line

in new high ground 34

30

Positive action: 28

- Tight weekly closes 26

- Support at 10-week line

At breakout, weekly volume Shows funds quietly buying 24

© 2013 Investor’s Business Daily, Inc.

95% higher than normal 22

Volume

1,660,000

860,000

440,000

220,000

Mar 06 Jun 06 Sep 06 Dec 06 Mar 07 Jun 07

Deckers Outdoor – 2007 Price

Daily Chart

Breakout

Buy point: 10 cents

above peak in base

Prior run-up 60

Support at

50-day line

Flat base 55

Relative strength line

in new high ground

© 2013 Investor’s Business Daily, Inc.

Volume 409% above average Volume

on day of breakout

300,000

140,000

60,000

20,000

24 8 22 5 19 2 16

December January February

Deckers Outdoor increased 175% from February–December 2007.