Page 259 - Office Practice and Accounting 10

P. 259

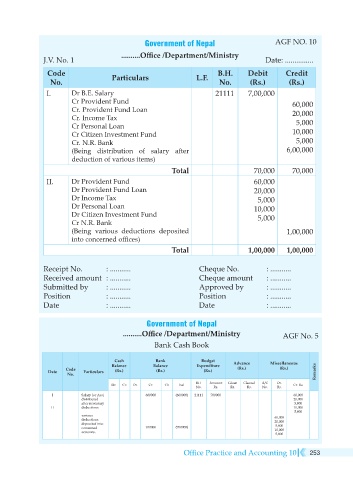

Government of Nepal AGF NO. 10

..........Office /Department/Ministry

J.V. No. 1 Date: ...............

Code Particulars L.F. B.H. Debit Credit

No. No. (Rs.) (Rs.)

I. Dr B.E. Salary 21111 7,00,000

Cr Provident Fund 60,000

Cr. Provident Fund Loan 20,000

Cr. Income Tax

Cr Personal Loan 5,000

Cr Citizen Investment Fund 10,000

Cr. N.R. Bank 5,000

(Being distribution of salary after 6,00,000

deduction of various items)

Total 70,000 70,000

II. Dr Provident Fund 60,000

Dr Provident Fund Loan 20,000

Dr Income Tax 5,000

Dr Personal Loan 10,000

Dr Citizen Investment Fund 5,000

Cr N.R. Bank

(Being various deductions deposited 1,00,000

into concerned offices)

Total 1,00,000 1,00,000

Receipt No. : ........... Cheque No. : ...........

Received amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

Government of Nepal

..........Office /Department/Ministry AGF No. 5

Bank Cash Book

Cash Bank Budget

Balance Balance Expenditure Advance Miscellaneous

Code (Rs.) (Rs.)

Date Particulars (Rs.) (Rs.) (Rs.) Remarks

No.

BH Amount Given Cleared A/C Dr.

Dr. Cr. Dr. Cr. Ch bal Cr. Rs.

No. Rs. Rs. Rs. No. Rs.

I Salary for Asoj 600000 (600000) 21111 700000 60,000

distributed 20,000

after necessary 5,000

II deductions 10,000

5,000

various 60,000

deductions 20,000

deposited into 5,000

concerned 100000 (700000) 10,000

accounts.

5,000

Office Practice and Accounting 10 253