Page 67 - mutual-fund-insight - Mar 2021_Neat

P. 67

For more on funds, visit www.valueresearchonline.com

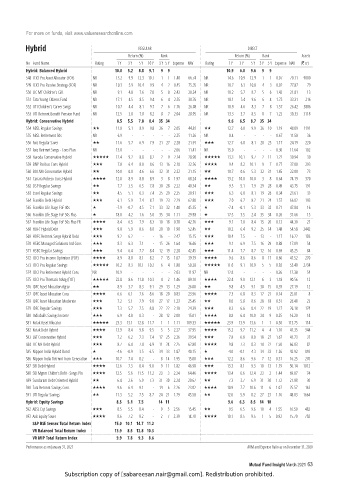

Hybrid REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Hybrid: Balanced Hybrid 10.0 5.2 8.8 9.1 9 9 10.9 6.0 9.6 9 9

548 ICICI Pru Asset Allocator (FOF) NR 13.2 9.9 12.3 10.7 1 1 1.40 66.74 NR 14.6 10.9 12.9 1 1 0.07 70.11 9000

549 ICICI Pru Passive Strategy (FOF) NR 10.3 5.9 10.4 9.9 4 2 0.45 75.35 NR 10.7 6.3 10.8 4 3 0.02 77.87 79

550 LIC MF Children’s Gift NR 9.1 4.8 7.6 7.0 5 8 2.42 20.24 NR 10.2 5.7 8.7 5 6 1.42 21.81 13

551 Tata Young Citizens Fund NR 17.1 4.5 8.5 9.4 6 4 2.55 30.76 NR 18.1 5.4 9.6 6 4 1.75 33.31 216

552 UTI Children’s Career Svngs NR 10.7 4.4 8.1 9.7 7 6 1.76 26.08 NR 10.9 4.6 8.3 7 8 1.57 26.42 3886

553 UTI Retrmnt Benefit Pension Fund NR 12.5 3.0 7.8 8.2 8 7 2.04 28.95 NR 13.3 3.7 8.5 8 7 1.22 30.33 3118

Hybrid: Conservative Hybrid 8.5 5.5 7.8 8.4 35 34 9.6 6.5 8.7 35 34

554 ABSL Regular Savings 11.8 5.1 8.9 9.8 26 7 2.05 44.81 12.7 6.0 9.9 26 10 1.19 48.09 1191

555 ABSL Retirement 50s NR 6.9 - - - - - 2.25 11.26 NR 8.4 - - - - 0.67 11.58 36

556 Axis Regular Saver 11.6 5.7 6.9 7.9 21 27 2.28 21.91 12.7 6.8 8.1 20 25 1.17 24.19 220

557 Axis Retrmnt Svngs - Cons Plan NR 13.0 - - - - - 2.06 11.41 NR 15.0 - - - - 0.30 11.64 102

558 Baroda Conservative Hybrid 12.4 9.2 8.8 8.2 2 9 2.14 28.90 13.3 10.1 9.7 2 11 1.22 30.94 30

559 BNP Paribas Cons Hybrid 7.8 6.4 8.0 8.6 13 16 2.18 32.56 9.4 8.2 10.1 9 7 0.77 37.00 293

560 BOI AXA Conservative Hybrid 10.0 0.0 4.6 6.6 32 31 2.32 21.15 10.7 0.6 5.3 32 31 1.65 22.00 73

561 Canara Robeco Cons Hybrid 12.0 8.9 8.8 8.9 3 8 1.97 68.24 13.2 10.0 10.0 3 8 0.64 74.19 370

562 DSP Regular Savings 7.7 3.5 6.5 7.8 30 28 2.22 40.34 9.5 5.1 7.9 29 28 0.49 43.75 191

563 Essel Regular Savings 4.5 5.1 6.3 7.4 25 29 2.25 20.91 6.3 6.8 8.1 19 26 0.34 23.61 33

564 Franklin Debt Hybrid 6.1 5.9 7.4 8.7 19 23 2.29 62.88 7.0 6.7 8.2 21 24 1.57 66.82 193

565 Franklin Life Stage FoF 40s -7.9 -0.7 4.5 7.1 33 32 1.40 45.35 -7.4 -0.1 5.3 33 32 0.71 47.84 16

566 Franklin Life Stage FoF 50s Plus -18.0 -4.2 1.6 5.0 35 34 1.11 29.98 -17.5 -3.5 2.4 35 34 0.26 31.66 15

567 Franklin Life Stage FoF 50s Plus FR 8.4 6.5 7.9 8.3 10 18 0.78 42.76 9.1 7.0 8.4 15 20 0.13 44.30 21

568 HDFC Hybrid Debt 9.8 5.9 8.6 8.8 20 10 1.90 52.45 10.2 6.4 9.2 25 14 1.48 54.58 2442

569 HDFC Retrmnt Svngs Hybrid Debt 9.2 6.2 - - 16 - 2.47 15.15 10.4 7.5 - 13 - 1.17 16.22 103

570 HSBC Managed Solutions Ind Cons 8.3 6.3 7.1 - 15 26 1.64 16.66 9.1 6.9 7.5 16 29 0.88 17.09 54

571 HSBC Regular Savings 9.4 6.4 7.7 8.4 12 19 2.28 42.45 11.4 7.7 8.7 12 16 0.69 45.25 84

572 ICICI Pru Income Optimizer (FOF) 8.9 8.0 8.1 8.2 7 15 1.07 39.79 9.6 8.6 8.6 8 17 0.60 41.52 270

573 ICICI Pru Regular Savings 10.2 8.3 10.1 10.2 6 4 1.80 50.28 11.0 9.1 10.9 5 5 0.92 53.40 2734

574 ICICI Pru Retirement Hybrid Cons NR 10.9 - - - - - 2.03 11.97 NR 12.8 - - - - 0.36 12.38 54

575 ICICI Pru Thematic Advtg (FOF) 22.8 8.6 11.8 10.3 4 2 1.46 89.10 22.4 9.0 12.1 6 3 1.18 90.56 12

576 IDFC Asset Allocation Agrsv 8.9 3.7 8.3 9.1 29 13 1.29 26.00 9.8 4.5 9.1 30 15 0.39 27.19 12

577 IDFC Asset Allocation Cons 6.6 6.1 7.6 8.6 18 20 0.83 23.96 7.3 6.8 8.3 17 21 0.14 25.01 8

578 IDFC Asset Allocation Moderate 7.2 5.1 7.9 9.0 27 17 1.23 25.45 8.0 5.8 8.6 28 18 0.51 26.48 23

579 IDFC Regular Savings 7.3 5.7 7.5 8.8 22 22 2.18 24.39 8.3 6.6 8.4 22 19 1.27 26.18 174

580 Indiabulls Savings Income 6.9 4.8 8.3 - 28 12 2.00 15.01 8.8 6.4 10.0 24 9 0.25 16.20 14

581 Kotak Asset Allocator 23.3 13.1 12.8 11.7 1 1 1.11 109.33 23.9 13.9 13.6 1 1 0.50 113.75 114

582 Kotak Debt Hybrid 13.9 8.4 9.8 9.5 5 5 2.27 37.95 15.2 9.7 11.2 4 4 1.10 41.35 344

583 L&T Conservative Hybrid 7.2 6.2 7.3 7.4 17 25 2.26 39.54 7.8 6.8 8.0 18 27 1.67 41.73 37

584 LIC MF Debt Hybrid 8.7 6.4 7.4 6.9 11 24 2.25 62.80 9.8 7.3 8.3 14 22 1.50 66.83 82

585 Nippon India Hybrid Bond -4.6 -0.9 3.5 6.5 34 33 1.87 40.15 -4.0 -0.1 4.3 34 33 1.26 42.92 893

586 Nippon India Retrmnt Incm Generation 10.7 7.4 8.2 - 8 14 1.95 15.00 12.2 8.6 9.6 7 12 0.31 16.25 270

587 SBI Debt Hybrid 12.6 7.3 8.4 9.0 9 11 1.82 46.98 13.3 8.1 9.3 10 13 1.19 50.14 1012

588 SBI Mgnm Chldrn’s Bnfit - Svngs Pln 12.5 5.6 11.5 11.2 23 3 2.24 64.46 13.4 6.6 12.4 23 2 1.44 69.07 74

589 Sundaram Debt Oriented Hybrid 6.4 2.6 5.9 7.3 31 30 2.24 20.67 7.3 3.7 6.9 31 30 1.72 21.88 30

590 Tata Retrmnt Savings Cons 9.6 6.4 9.1 - 14 6 2.26 23.02 10.9 7.7 10.6 11 6 1.07 25.57 163

591 UTI Regular Savings 11.3 5.2 7.5 8.7 24 21 1.79 45.58 12.0 5.9 8.2 27 23 1.16 48.03 1664

Hybrid: Equity Savings 8.5 5.1 7.5 14 11 9.6 6.3 8.5 14 10

592 ABSL Eqt Savings 8.5 5.5 8.4 - 9 5 2.56 15.45 9.5 6.5 9.6 10 4 1.55 16.50 482

593 Axis Equity Saver 8.6 7.2 8.2 - 2 7 2.39 14.70 10.1 8.5 9.5 1 5 0.92 15.70 702

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

VR Balanced Total Return Index 13.9 8.5 12.8 10.3

VR MIP Total Return Index 9.9 7.8 9.3 8.6

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 63

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.