Page 74 - mutual-fund-insight - Mar 2021_Neat

P. 74

For more on funds, visit www.valueresearchonline.com

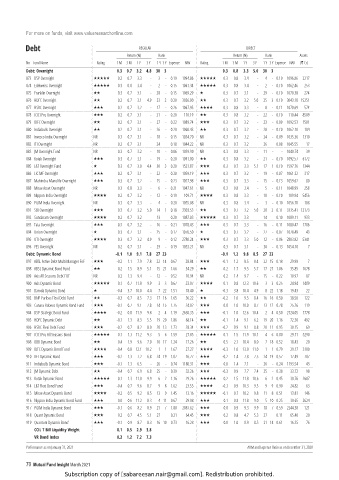

Debt REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV (` Cr)

Debt: Overnight 0.3 0.7 3.2 4.8 30 3 0.3 0.8 3.3 5.0 30 3

873 DSP Overnight 0.2 0.7 3.3 - 3 - 0.19 1094.86 0.3 0.8 3.4 - 4 - 0.10 1096.86 2217

874 Edelweiss Overnight 0.3 0.8 3.4 - 2 - 0.15 1061.34 0.3 0.8 3.4 - 2 - 0.10 1062.46 253

875 Franklin Overnight 0.3 0.7 3.1 - 28 - 0.15 1069.29 0.3 0.7 3.1 - 29 - 0.10 1070.38 274

876 HDFC Overnight 0.2 0.7 3.1 4.9 23 2 0.20 3026.00 0.3 0.7 3.2 5.0 25 3 0.10 3043.18 15251

877 HSBC Overnight 0.2 0.7 3.2 - 17 - 0.26 1067.95 0.3 0.8 3.3 - 8 - 0.11 1070.69 574

878 ICICI Pru Overnight 0.2 0.7 3.1 - 21 - 0.20 110.19 0.3 0.8 3.2 - 22 - 0.10 110.44 8589

879 IDFC Overnight 0.2 0.7 3.1 - 27 - 0.22 1089.74 0.3 0.7 3.2 - 23 - 0.09 1092.53 1501

880 Indiabulls Overnight 0.2 0.7 3.1 - 26 - 0.20 1060.43 0.3 0.7 3.2 - 28 - 0.10 1062.10 104

881 Invesco India Overnight NR 0.3 0.7 3.1 - 18 - 0.15 1034.70 NR 0.3 0.7 3.2 - 24 - 0.09 1035.36 1310

882 ITI Overnight NR 0.2 0.7 3.1 - 24 - 0.18 1044.22 NR 0.3 0.7 3.2 - 26 - 0.08 1045.55 17

883 JM Overnight Fund NR 0.3 0.7 3.2 - 10 - 0.06 1039.90 NR 0.3 0.8 3.3 - 11 - - 1040.74 39

884 Kotak Overnight 0.3 0.7 3.1 - 19 - 0.20 1091.00 0.3 0.8 3.2 - 21 - 0.10 1092.57 6172

885 L&T Overnight Fund 0.3 0.7 3.0 4.4 30 3 0.20 1521.87 0.3 0.7 3.3 5.1 17 1 0.10 1597.76 1344

886 LIC MF Overnight 0.2 0.7 3.1 - 22 - 0.20 1059.19 0.3 0.7 3.2 - 19 - 0.07 1061.32 317

887 Mahindra Manulife Overnight 0.3 0.7 3.2 - 15 - 0.23 1057.98 0.3 0.7 3.3 - 15 - 0.13 1059.62 80

888 Mirae Asset Overnight NR 0.3 0.8 3.3 - 6 - 0.21 1047.61 NR 0.3 0.8 3.4 - 5 - 0.11 1048.99 258

889 Nippon India Overnight 0.2 0.7 3.2 - 12 - 0.19 109.71 0.3 0.8 3.3 - 10 - 0.10 109.94 5456

890 PGIM India Overnight NR 0.3 0.7 3.3 - 4 - 0.20 1055.08 NR 0.3 0.8 3.4 - 3 - 0.10 1056.70 108

891 SBI Overnight 0.3 0.7 3.2 5.0 14 1 0.18 3303.53 0.3 0.7 3.2 5.0 20 2 0.11 3335.41 12173

892 Sundaram Overnight 0.2 0.7 3.2 - 13 - 0.20 1087.03 0.3 0.7 3.3 - 14 - 0.10 1089.11 933

893 Tata Overnight 0.3 0.7 3.2 - 16 - 0.21 1078.43 0.3 0.7 3.3 - 16 - 0.11 1080.47 1786

894 Union Overnight 0.3 0.7 3.1 - 25 - 0.17 1076.50 0.3 0.7 3.2 - 27 - 0.07 1078.49 43

895 UTI Overnight 0.3 0.7 3.2 4.9 9 - 0.12 2780.24 0.3 0.7 3.3 5.0 12 - 0.06 2803.82 5341

896 YES Overnight NR 0.2 0.7 3.1 - 29 - 0.19 1053.21 NR 0.3 0.7 3.1 - 30 - 0.13 1054.10 7

Debt: Dynamic Bond -0.1 1.0 9.1 7.8 27 23 -0.1 1.2 9.8 8.5 27 23

897 ABSL Active Debt Multi Manager FoF -0.2 1.1 7.9 7.8 22 14 0.67 28.84 -0.1 1.2 8.5 8.4 22 15 0.18 29.98 7

898 ABSL Dynamic Bond Fund 0.2 1.5 8.9 5.1 15 21 1.66 34.29 0.2 1.7 9.5 5.7 17 21 1.06 35.85 1678

899 Axis All Seasons Debt FOF NR 0.2 1.3 9.4 - 12 - 0.52 10.94 NR 0.2 1.4 9.7 - 15 - 0.22 10.97 87

900 Axis Dynamic Bond 0.1 0.7 11.8 9.9 3 3 0.67 23.07 0.1 0.8 12.3 10.6 3 3 0.25 24.94 1489

901 Baroda Dynamic Bond -0.4 3.7 10.0 4.4 7 22 1.51 18.40 -0.3 3.8 10.4 4.9 8 22 1.18 19.43 22

902 BNP Paribas Flexi Debt Fund -0.3 0.7 8.5 7.3 17 16 1.65 36.22 -0.2 1.0 9.5 8.4 16 16 0.50 38.50 122

903 Canara Robeco Dynamic Bond Fund -0.1 0.7 9.1 7.8 14 15 1.75 24.02 0.0 1.0 10.0 8.7 13 12 0.78 25.26 119

904 DSP Strategic Bond Fund -0.2 0.8 11.9 9.8 2 4 1.19 2630.35 -0.1 1.0 12.6 10.4 2 4 0.50 2724.05 1778

905 HDFC Dynamic Debt -0.1 1.3 8.3 5.5 19 20 1.86 68.14 -0.1 1.4 9.1 6.2 19 20 1.16 72.30 492

906 HSBC Flexi Debt Fund -0.2 0.7 8.2 8.0 20 13 1.73 28.34 -0.2 0.9 9.1 8.8 20 11 0.95 30.15 69

907 ICICI Pru All Seasons Bond 0.1 1.3 11.2 9.3 5 6 1.59 27.85 0.1 1.5 11.9 10.1 4 6 0.80 29.11 5290

908 IDBI Dynamic Bond 0.4 1.9 9.6 7.0 10 17 1.24 17.26 0.5 2.1 10.4 8.0 7 18 0.52 18.43 20

909 IDFC Dynamic Bond Fund -0.4 0.8 12.1 10.2 1 1 1.67 27.27 -0.3 1.0 13.0 11.0 1 1 0.79 29.17 3100

910 IIFL Dynamic Bond -0.2 1.3 7.2 6.8 24 19 1.07 16.77 -0.2 1.4 7.8 7.5 24 19 0.57 17.49 707

911 Indiabulls Dynamic Bond -0.1 1.3 6.5 - 26 - 0.74 1180.31 0.0 1.4 7.1 - 26 - 0.24 1193.54 43

912 JM Dynamic Debt -0.4 0.7 6.9 6.8 25 - 0.39 32.26 -0.3 0.9 7.7 7.4 25 - 0.38 33.72 98

913 Kotak Dynamic Bond 0.1 1.3 11.0 9.9 6 2 1.16 29.26 0.2 1.5 11.8 10.6 6 2 0.45 30.76 2607

914 L&T Flexi Bond Fund -0.4 0.7 9.6 8.7 9 8 1.62 23.55 -0.3 0.9 10.3 9.5 9 9 0.90 24.82 63

915 Mirae Asset Dynamic Bond -0.2 0.5 9.2 8.5 13 9 1.45 13.16 -0.1 0.7 10.2 9.8 11 8 0.51 13.81 146

916 Nippon India Dynamic Bond Fund 0.0 0.6 11.2 8.3 4 11 0.67 29.08 0.1 0.8 11.8 9.0 5 10 0.25 30.65 2624

917 PGIM India Dynamic Bond -0.1 0.6 8.2 8.9 21 7 1.80 2087.62 0.0 0.9 9.3 9.9 18 7 0.59 2244.38 121

918 Quant Dynamic Bond 0.2 0.7 4.5 5.1 27 - 0.21 64.45 0.2 0.8 4.7 5.3 27 - 0.11 65.40 20

919 Quantum Dynamic Bond -0.1 0.9 8.7 8.3 16 10 0.73 16.28 0.0 1.0 8.9 8.5 21 14 0.61 16.35 76

CCIL T Bill Liquidity Weight 0.1 0.5 2.9 3.8

VR Bond Index 0.2 1.2 7.2 7.3

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

70 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.