Page 73 - mutual-fund-insight - Mar 2021_Neat

P. 73

For more on funds, visit www.valueresearchonline.com

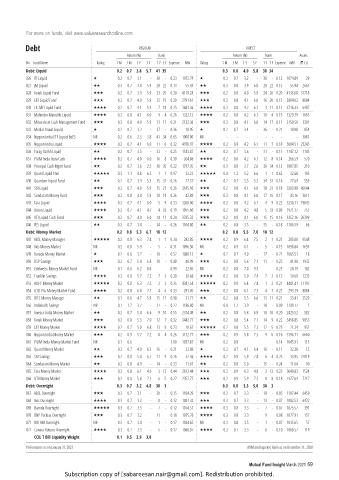

Debt REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV (` Cr)

Debt: Liquid 0.2 0.7 3.8 5.7 41 35 0.3 0.8 4.0 5.8 38 34

826 ITI Liquid 0.2 0.7 3.1 - 38 - 0.23 1072.74 0.3 0.7 3.2 - 38 - 0.12 1074.84 29

827 JM Liquid 0.3 0.7 3.8 5.9 28 22 0.13 55.59 0.3 0.8 3.9 6.0 28 22 0.15 55.94 2661

828 Kotak Liquid Fund 0.2 0.7 3.9 5.9 23 25 0.30 4119.28 0.2 0.8 4.0 5.9 24 26 0.20 4136.68 31718

829 L&T Liquid Fund 0.2 0.7 4.0 5.9 12 15 0.20 2791.61 0.2 0.8 4.1 6.0 16 20 0.15 2804.02 8084

830 LIC MF Liquid Fund 0.2 0.7 4.1 5.9 7 18 0.25 3683.36 0.3 0.8 4.2 6.1 3 11 0.11 3716.33 6407

831 Mahindra Manulife Liquid 0.2 0.8 4.1 6.0 9 4 0.26 1322.12 0.2 0.8 4.2 6.1 10 4 0.15 1329.79 1665

832 Mirae Asset Cash Management Fund 0.3 0.8 4.0 5.9 13 17 0.21 2132.36 0.3 0.8 4.1 6.0 14 17 0.11 2159.50 3301

833 Motilal Oswal Liquid 0.2 0.7 3.2 - 37 - 0.36 10.95 0.2 0.7 3.4 - 36 - 0.21 10.98 854

834 Nippon India ETF Liquid BeES NR 0.2 0.6 2.3 3.8 41 34 0.65 1000.00 NR - - - - - - - - 3061

835 Nippon India Liquid 0.2 0.7 4.1 6.0 11 6 0.32 4970.97 0.2 0.8 4.2 6.1 11 7 0.18 5004.51 23245

836 Parag Parikh Liquid 0.2 0.7 3.5 - 33 - 0.25 1143.87 0.2 0.7 3.6 - 31 - 0.15 1147.12 1145

837 PGIM India Insta Cash 0.2 0.7 4.0 6.0 16 8 0.30 264.86 0.2 0.8 4.2 6.1 12 8 0.14 266.59 570

838 Principal Cash Mgmt Fund 0.2 0.7 3.6 2.5 30 35 0.22 1797.35 0.3 0.8 3.7 2.6 30 34 0.13 1807.85 210

839 Quant Liquid Plan 0.3 1.1 4.8 6.3 1 1 0.97 32.22 0.4 1.2 5.2 6.6 1 1 0.62 32.68 105

840 Quantum Liquid Fund 0.2 0.7 3.4 5.3 35 32 0.26 27.57 0.2 0.7 3.5 5.3 34 31 0.16 27.64 559

841 SBI Liquid 0.2 0.7 4.0 5.9 15 21 0.26 3185.96 0.2 0.8 4.1 6.0 18 21 0.18 3203.98 45644

842 Sundaram Money Fund 0.2 0.8 4.0 5.9 18 14 0.26 42.89 0.3 0.8 4.1 6.0 17 16 0.17 43.16 3611

843 Tata Liquid 0.2 0.7 4.1 6.0 5 9 0.33 3208.00 0.2 0.8 4.2 6.1 4 9 0.22 3230.11 19843

844 Union Liquid 0.2 0.7 4.1 4.7 4 33 0.19 1955.60 0.2 0.8 4.2 4.8 5 33 0.09 1971.17 751

845 UTI Liquid Cash Fund 0.2 0.7 4.0 6.0 14 11 0.24 3335.32 0.2 0.8 4.1 6.0 15 15 0.16 3352.16 26399

846 YES Liquid 0.2 0.7 3.4 - 34 - 0.26 1104.80 0.2 0.8 3.5 - 35 - 0.18 1106.59 66

Debt: Money Market 0.2 0.8 5.3 6.7 18 12 0.2 0.8 5.5 7.0 18 12

847 ABSL Money Manager 0.2 0.8 6.3 7.4 1 1 0.34 282.85 0.2 0.9 6.4 7.5 2 1 0.21 285.00 9548

848 Axis Money Market NR 0.2 0.8 5.9 - 5 - 0.31 1096.50 NR 0.2 0.9 6.1 - 5 - 0.15 1098.84 1659

849 Baroda Money Market 0.2 0.6 3.7 - 18 - 0.52 1080.13 0.2 0.7 4.0 - 17 - 0.21 1085.51 18

850 DSP Savings 0.2 0.7 5.4 6.8 10 - 0.48 40.99 0.2 0.8 5.6 7.1 11 - 0.23 41.80 1932

851 Edelweiss Money Market Fund NR 0.1 0.6 6.2 8.6 - - 0.99 22.65 NR 0.2 0.8 7.0 9.3 - - 0.21 24.19 182

852 Franklin Savings 0.2 0.8 5.7 7.2 7 3 0.28 38.68 0.2 0.8 5.9 7.4 7 3 0.13 39.69 1233

853 HDFC Money Market 0.2 0.8 6.3 7.2 2 2 0.35 4387.54 0.2 0.9 6.4 7.4 1 2 0.21 4441.41 11197

854 ICICI Pru Money Market Fund 0.2 0.8 6.0 7.1 4 6 0.33 291.05 0.2 0.8 6.1 7.3 4 7 0.21 293.19 8884

855 IDFC Money Manager 0.1 0.6 4.7 5.9 15 11 0.98 31.71 0.2 0.8 5.5 6.6 13 11 0.21 33.41 2529

856 Indiabulls Savings NR 0.7 1.2 3.7 - 17 - 0.22 1146.80 NR 0.8 1.2 3.9 - 18 - 0.09 1149.77 1

857 Invesco India Money Market 0.2 0.7 5.4 6.6 9 10 0.55 2374.49 0.2 0.8 5.8 6.9 10 10 0.20 2425.52 582

858 Kotak Money Market 0.2 0.8 5.3 7.0 12 7 0.32 3442.71 0.2 0.8 5.4 7.1 14 9 0.22 3458.85 9853

859 L&T Money Market 0.2 0.7 5.0 6.8 13 8 0.73 20.67 0.2 0.8 5.5 7.3 12 5 0.25 21.34 952

860 Nippon India Money Market 0.2 0.9 5.7 7.2 8 4 0.26 3172.77 0.2 0.9 5.8 7.3 9 6 0.16 3196.71 6660

861 PGIM India Money Market Fund NR 0.1 0.6 - - - - 1.00 1037.87 NR 0.2 0.8 - - - - 0.14 1045.91 113

862 Quant Money Market 0.2 0.7 4.0 6.3 16 - 0.21 32.08 0.2 0.7 4.1 6.4 16 - 0.11 32.38 12

863 SBI Savings 0.2 0.8 5.4 6.7 11 9 0.76 32.36 0.2 0.9 5.9 7.4 6 4 0.23 33.95 22019

864 Sundaram Money Market 0.2 0.8 4.9 - 14 - 0.33 11.61 0.2 0.8 5.0 - 15 - 0.24 11.64 90

865 Tata Money Market 0.2 0.8 6.1 4.6 3 12 0.44 3612.44 0.2 0.9 6.3 4.8 3 12 0.23 3640.83 1524

866 UTI Money Market 0.2 0.8 5.8 7.1 6 5 0.27 2357.77 0.2 0.9 5.9 7.3 8 8 0.18 2377.64 7217

Debt: Overnight 0.3 0.7 3.2 4.8 30 3 0.3 0.8 3.3 5.0 30 3

867 ABSL Overnight 0.3 0.7 3.1 - 20 - 0.15 1104.29 0.3 0.7 3.3 - 18 - 0.05 1107.44 6459

868 Axis Overnight 0.3 0.7 3.2 - 8 - 0.12 1081.32 0.3 0.7 3.3 - 13 - 0.07 1082.53 6472

869 Baroda Overnight 0.3 0.7 3.3 - 7 - 0.12 1074.51 0.3 0.8 3.3 - 7 - 0.07 1075.57 391

870 BNP Paribas Overnight 0.3 0.7 3.2 - 11 - 0.18 1075.76 0.3 0.8 3.3 - 9 - 0.08 1077.91 157

871 BOI AXA Overnight NR 0.3 0.7 3.4 - 1 - 0.17 1034.65 NR 0.3 0.8 3.5 - 1 - 0.07 1035.65 57

872 Canara Robeco Overnight 0.3 0.7 3.3 - 5 - 0.12 1060.07 0.3 0.7 3.3 - 6 - 0.10 1060.57 119

CCIL T Bill Liquidity Weight 0.1 0.5 2.9 3.8

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 69

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.