Page 72 - mutual-fund-insight - Mar 2021_Neat

P. 72

For more on funds, visit www.valueresearchonline.com

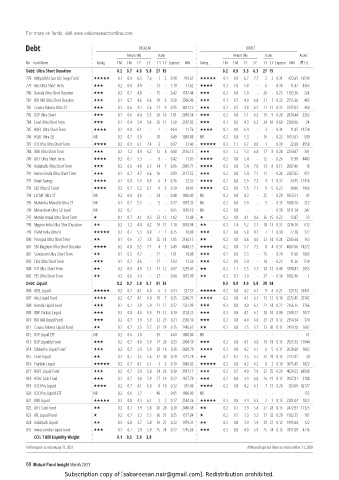

Debt REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV (` Cr)

Debt: Ultra Short Duration 0.2 0.7 4.8 5.8 27 15 0.2 0.9 5.3 6.3 27 15

778 Aditya Birla Sun Life Svngs Fund 0.1 0.9 6.5 7.6 1 2 0.48 419.67 0.1 0.9 6.7 7.7 2 2 0.34 423.65 16540

779 Axis Ultra Short Term 0.2 0.8 4.9 - 13 - 1.19 11.62 0.3 1.0 5.8 - 6 - 0.30 11.87 4363

780 Baroda Ultra Short Duration 0.2 0.7 4.8 - 15 - 0.42 1187.44 0.2 0.8 5.0 - 20 - 0.23 1193.36 224

781 BOI AXA Ultra Short Duration 0.1 0.7 4.6 6.6 18 6 0.58 2506.46 0.1 0.7 4.9 6.8 21 7 0.33 2553.36 403

782 Canara Robeco Ultra ST 0.1 0.6 4.2 5.6 21 9 0.95 3031.13 0.2 0.7 4.8 6.2 22 11 0.32 3147.03 460

783 DSP Ultra Short 0.1 0.6 4.4 5.5 20 10 1.01 2690.54 0.2 0.8 5.1 6.3 19 9 0.28 2834.44 3263

784 Essel Ultra Short Term 0.1 0.4 3.4 5.4 26 11 1.60 2187.02 0.1 0.6 4.3 6.3 24 10 0.69 2300.96 24

785 HDFC Ultra Short Term 0.2 0.8 6.1 - 2 - 0.64 11.76 0.2 0.9 6.4 - 3 - 0.34 11.85 14228

786 HSBC Ultra SD NR 0.2 0.7 5.0 - 10 - 0.49 1050.88 NR 0.2 0.8 5.3 - 16 - 0.22 1053.61 580

787 ICICI Pru Ultra Short Term 0.2 0.9 6.1 7.4 3 - 0.97 21.40 0.3 1.1 6.7 8.0 1 - 0.39 22.68 8558

788 IDBI Ultra Short Term 0.3 1.2 4.9 6.2 12 8 0.60 2156.13 0.3 1.2 5.3 6.8 17 8 0.28 2254.67 381

789 IDFC Ultra Short Term 0.2 0.7 5.3 - 8 - 0.42 11.85 0.2 0.8 5.4 - 12 - 0.26 11.90 4443

790 Indiabulls Ultra Short Term 0.2 0.6 4.8 6.5 14 7 0.66 2009.71 0.3 0.8 5.4 7.0 13 6 0.11 2087.46 18

791 Invesco India Ultra Short Term 0.1 0.7 4.7 6.6 16 - 0.89 2117.52 0.2 0.8 5.4 7.1 11 - 0.24 2207.02 971

792 Kotak Savings 0.1 0.8 5.4 6.9 6 4 0.76 33.53 0.2 0.8 5.9 7.3 4 3 0.32 34.45 12428

793 L&T Ultra ST Fund 0.2 0.7 5.2 6.7 9 5 0.39 34.01 0.2 0.8 5.5 7.1 9 5 0.23 34.86 1966

794 LIC MF Ultra ST NR 0.2 0.8 4.0 - 24 - 0.40 1050.40 NR 0.2 0.8 4.3 - 25 - 0.20 1053.51 95

795 Mahindra Manulife Ultra ST NR 0.1 0.7 5.5 - 5 - 0.77 1074.33 NR 0.2 0.8 5.9 - 5 - 0.35 1080.18 212

796 Mirae Asset Ultra SD Fund NR 0.2 0.7 - - - - 0.65 1010.10 NR 0.2 0.8 - - - - 0.30 1011.14 247

797 Motilal Oswal Ultra Short Term 0.1 0.7 4.1 0.5 23 15 1.02 13.48 0.2 0.8 4.1 0.6 26 15 0.22 13.87 33

798 Nippon India Ultra Short Duration 0.2 1.2 4.4 4.2 19 13 1.10 3018.94 0.3 1.4 5.2 5.1 18 13 0.33 3216.10 612

799 PGIM India Ultra ST 0.2 0.7 5.3 8.9 7 1 0.75 26.89 0.2 0.8 5.8 9.2 7 1 0.30 27.38 327

800 Principal Ultra Short Term 0.1 0.6 3.7 3.8 25 14 1.05 2165.13 0.2 0.8 4.6 4.6 23 14 0.24 2245.64 163

801 SBI Magnum Ultra Short Duration 0.2 0.8 5.5 7.1 4 3 0.49 4648.13 0.2 0.8 5.7 7.3 8 4 0.31 4687.66 14272

802 Sundaram Ultra Short Term 0.1 0.5 4.2 - 22 - 1.61 10.80 0.2 0.9 5.3 - 15 - 0.20 11.00 1003

803 Tata Ultra Short Term 0.1 0.7 4.6 - 17 - 1.03 11.20 0.2 0.9 5.4 - 14 - 0.23 11.36 519

804 UTI Ultra Short Term 0.2 0.9 4.9 5.1 11 12 0.97 3239.45 0.2 1.1 5.5 5.7 10 12 0.49 3390.81 2055

805 YES Ultra Short Term 0.2 0.6 3.4 - 27 - 0.80 1072.99 0.2 0.7 3.9 - 27 - 0.30 1082.46 1

Debt: Liquid 0.2 0.7 3.8 5.7 41 35 0.3 0.8 4.0 5.8 38 34

806 ABSL Liquid 0.2 0.7 4.1 6.0 6 5 0.31 327.57 0.2 0.8 4.2 6.1 9 6 0.21 329.72 33431

807 Axis Liquid Fund 0.2 0.7 4.1 6.0 10 7 0.25 2260.71 0.2 0.8 4.1 6.1 13 12 0.18 2272.45 25742

808 Baroda Liquid Fund 0.2 0.7 3.9 5.9 21 12 0.32 2337.99 0.3 0.8 4.0 6.1 21 14 0.22 2356.15 3266

809 BNP Paribas Liquid 0.3 0.8 4.0 5.9 19 13 0.18 3124.25 0.3 0.8 4.1 6.1 20 10 0.08 3149.17 1077

810 BOI AXA Liquid Fund 0.2 0.7 3.9 5.9 22 23 0.21 2336.50 0.2 0.8 4.0 6.0 23 23 0.12 2354.34 374

811 Canara Robeco Liquid Fund 0.2 0.7 3.5 5.7 31 29 0.15 2446.67 0.2 0.8 3.5 5.7 33 30 0.11 2454.18 1602

812 DSP Liquid ETF NR 0.2 0.6 3.0 - 39 - 0.60 1000.00 NR - - - - - - - - 67

813 DSP Liquidity Fund 0.2 0.7 4.0 5.9 17 20 0.23 2904.39 0.2 0.8 4.1 6.0 19 18 0.15 2925.32 11944

814 Edelweiss Liquid Fund 0.2 0.7 3.9 5.9 20 16 0.36 2609.70 0.3 0.8 4.2 6.1 6 5 0.11 2638.68 1063

815 Essel Liquid 0.2 0.7 3.5 5.6 32 30 0.20 2221.78 0.2 0.7 3.5 5.7 32 29 0.15 2237.02 34

816 Franklin Liquid 0.2 0.7 4.1 6.1 3 2 0.19 3060.02 0.2 0.8 4.2 6.2 8 2 0.10 3075.45 1822

817 HDFC Liquid Fund 0.2 0.7 3.9 5.8 24 26 0.30 3997.17 0.2 0.7 4.0 5.9 22 25 0.20 4024.22 68508

818 HSBC Cash Fund 0.2 0.7 3.8 5.9 27 19 0.22 2027.79 0.2 0.8 3.9 6.0 26 19 0.12 2037.81 3188

819 ICICI Pru Liquid 0.2 0.7 4.1 6.0 8 10 0.32 301.46 0.2 0.8 4.2 6.1 7 13 0.20 303.09 42177

820 ICICI Pru Liquid ETF NR 0.2 0.6 2.7 - 40 - 0.65 1000.00 NR - - - - - - - - 133

821 IDBI Liquid 0.3 0.8 4.3 6.1 2 3 0.17 2184.26 0.3 0.8 4.4 6.2 2 3 0.13 2201.04 1023

822 IDFC Cash Fund 0.2 0.7 3.9 5.8 26 28 0.20 2460.68 0.2 0.7 3.9 5.8 27 28 0.15 2472.93 11325

823 IIFL Liquid Fund 0.2 0.7 3.3 5.3 36 31 0.25 1577.04 0.2 0.7 3.3 5.3 37 32 0.20 1582.75 167

824 Indiabulls Liquid 0.3 0.8 3.7 5.8 29 27 0.22 1979.31 0.3 0.8 3.9 5.9 29 27 0.12 1995.04 122

825 Invesco India Liquid Fund 0.2 0.7 3.9 5.9 25 24 0.22 2795.66 0.3 0.8 4.0 5.9 25 24 0.15 2811.09 4716

CCIL T Bill Liquidity Weight 0.1 0.5 2.9 3.8

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

68 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.