Page 68 - mutual-fund-insight - Mar 2021_Neat

P. 68

For more on funds, visit www.valueresearchonline.com

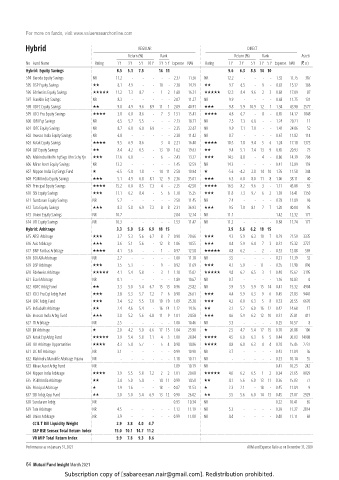

Hybrid REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Hybrid: Equity Savings 8.5 5.1 7.5 14 11 9.6 6.3 8.5 14 10

594 Baroda Equity Savings NR 11.2 - - - - - 2.37 11.56 NR 12.2 - - - - 1.32 11.75 387

595 DSP Equity Savings 8.1 4.9 - - 10 - 2.38 14.29 9.7 6.5 - 9 - 0.83 15.32 386

596 Edelweiss Equity Savings 11.2 7.3 8.7 - 1 2 1.68 16.31 12.3 8.4 9.6 2 3 0.68 17.09 87

597 Franklin Eqt Savings NR 8.3 - - - - - 2.07 11.27 NR 9.9 - - - - 0.68 11.75 131

598 HDFC Equity Savings 9.0 4.9 9.6 8.9 11 1 2.09 40.91 9.8 5.9 10.9 12 1 1.34 43.98 2577

599 ICICI Pru Equity Savings 3.8 6.0 8.6 - 7 3 1.51 15.41 4.6 6.7 - 8 - 0.85 14.17 1048

600 IDBI Eqt Savings NR 6.5 5.7 5.5 - - - 2.13 18.71 NR 7.5 7.3 6.8 - - 1.24 20.21 11

601 IDFC Equity Savings NR 8.7 6.0 6.0 6.9 - - 2.35 22.67 NR 9.9 7.1 7.0 - - 1.41 24.06 52

602 Invesco India Equity Savings NR 6.8 - - - - - 2.38 11.42 NR 8.7 - - - - 0.67 11.82 114

603 Kotak Equity Savings 9.5 6.9 8.6 - 3 4 2.21 16.40 10.5 7.8 9.4 5 6 1.24 17.18 1373

604 L&T Equity Savings 8.4 4.2 6.5 - 13 10 1.62 19.63 9.4 5.1 7.4 13 9 0.85 20.93 73

605 Mahindra Mnlfe EqtSvgs Dhn Schy Yjn 12.6 6.0 - - 6 - 2.43 13.32 14.5 8.0 - 4 - 0.86 14.39 206

606 Mirae Asset Equity Savings NR 13.2 - - - - - 1.45 12.59 NR 14.3 - - - - 0.41 12.89 159

607 Nippon India Eqt Svngs Fund -6.5 -5.0 1.8 - 14 11 2.58 10.94 -5.6 -4.2 2.8 14 10 1.76 11.58 344

608 PGIM India Equity Savings 5.1 4.9 6.8 8.1 12 9 2.36 35.01 6.3 6.0 8.0 11 8 1.06 38.11 40

609 Principal Equity Savings 15.2 6.8 8.5 7.3 4 - 2.35 42.50 16.5 8.2 9.6 3 - 1.11 45.88 55

610 SBI Equity Savings 11.1 6.2 8.4 - 5 6 1.70 15.25 11.8 7.3 9.7 6 2 1.03 16.41 1350

611 Sundaram Equity Savings NR 5.7 - - - - - 2.50 11.45 NR 7.4 - - - - 0.78 11.89 96

612 Tata Equity Savings 8.3 5.8 6.9 7.2 8 8 2.31 36.93 9.5 7.0 8.1 7 7 1.20 40.04 95

613 Union Equity Savings NR 10.7 - - - - - 2.04 12.14 NR 11.1 - - - - 1.42 12.32 171

614 UTI Equity Savings NR 10.3 - - - - - 1.53 11.47 NR 11.2 - - - - 0.68 11.74 177

Hybrid: Arbitrage 3.3 5.0 5.6 6.9 18 15 3.9 5.6 6.2 18 15

615 ABSL Arbitrage 3.7 5.3 5.6 6.7 8 7 0.90 20.66 4.3 5.9 6.3 10 7 0.29 21.59 3335

616 Axis Arbitrage 3.6 5.1 5.6 - 12 8 1.06 14.55 4.4 5.9 6.4 7 3 0.31 15.32 2727

617 BNP Paribas Arbitrage 4.1 5.6 - - 1 - 0.97 12.58 4.8 6.2 - 2 - 0.33 12.88 569

618 BOI AXA Arbitrage NR 2.7 - - - - - 1.00 11.18 NR 3.5 - - - - 0.21 11.39 32

619 DSP Arbitrage 3.5 5.3 - - 9 - 0.92 11.69 4.1 5.9 - 11 - 0.35 11.90 896

620 Edelweiss Arbitrage 4.1 5.4 5.8 - 3 1 1.10 15.02 4.8 6.2 6.5 3 1 0.40 15.62 3195

621 Essel Arbitrage NR 0.1 - - - - - 1.89 10.67 NR 0.7 - - - - 1.16 10.83 0

622 HDFC Arbtg Fund 3.3 5.0 5.4 6.7 15 13 0.96 23.82 NR 3.9 5.5 5.9 15 14 0.41 15.32 4904

623 ICICI Pru Eqt Arbtg Fund 3.8 5.3 5.7 7.2 7 6 0.98 26.61 4.4 5.9 6.3 9 6 0.45 27.83 9441

624 IDFC Arbtg Fund 3.4 5.2 5.5 7.0 10 10 1.09 25.30 4.2 6.0 6.3 5 8 0.33 26.55 6670

625 Indiabulls Arbitrage 2.4 4.6 5.4 - 16 14 1.12 14.16 3.1 5.2 6.0 16 12 0.42 14.68 17

626 Invesco India Arbtg Fund 3.8 5.2 5.6 6.8 11 9 1.01 24.58 4.6 5.9 6.2 12 10 0.31 25.81 411

627 ITI Arbitrage NR 2.5 - - - - - 1.00 10.46 NR 3.3 - - - - 0.25 10.57 8

628 JM Arbitrage 2.0 4.2 5.0 6.6 17 15 1.04 25.90 2.5 4.7 5.4 17 15 0.70 26.88 106

629 Kotak Eqt Arbtg Fund 3.9 5.4 5.8 7.1 4 3 1.00 28.84 4.5 6.0 6.3 6 5 0.44 30.03 14908

630 L&T Arbitrage Opportunities 4.3 5.4 5.7 - 5 4 0.98 14.86 4.8 6.0 6.3 4 4 0.28 15.45 2737

631 LIC MF Arbitrage NR 3.1 - - - - - 0.99 10.90 NR 3.7 - - - - 0.43 11.04 36

632 Mahindra Manulife Arbitrage Yojana NR - - - - - - 1.18 10.11 NR - - - - - 0.33 10.14 55

633 Mirae Asset Arbtg Fund NR - - - - - - 1.09 10.19 NR - - - - - 0.41 10.23 242

634 Nippon India Arbitrage 3.9 5.5 5.8 7.2 2 2 1.01 20.68 4.6 6.2 6.5 1 2 0.34 21.65 8029

635 PGIM India Arbitrage 3.4 5.0 5.4 - 14 11 0.99 14.50 4.1 5.6 6.0 13 11 0.36 15.03 77

636 Principal Arbitrage 1.9 1.6 - - 18 - 0.87 11.53 2.3 2.1 - 18 - 0.45 11.84 9

637 SBI Arbtg Opp Fund 3.0 5.0 5.4 6.9 13 12 0.90 26.02 3.5 5.6 6.0 14 13 0.45 27.07 2929

638 Sundaram Arbtg NR - - - - - - 0.93 10.34 NR - - - - - 0.22 10.41 65

639 Tata Arbitrage NR 4.5 - - - - - 1.13 11.19 NR 5.3 - - - - 0.38 11.37 2814

640 Union Arbitrage NR 3.9 - - - - - 0.99 11.00 NR 4.4 - - - - 0.40 11.11 68

CCIL T Bill Liquidity Weight 2.9 3.8 4.0 4.7

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

VR MIP Total Return Index 9.9 7.8 9.3 8.6

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

64 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.