Page 71 - mutual-fund-insight - Mar 2021_Neat

P. 71

For more on funds, visit www.valueresearchonline.com

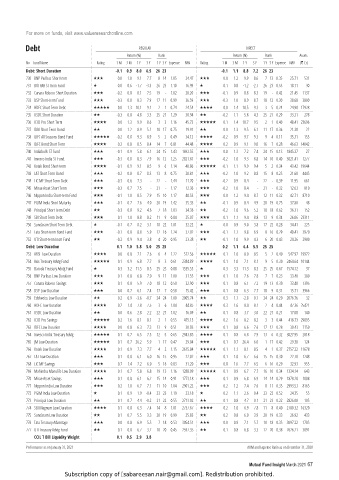

Debt REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV Rating 1 M 3 M 1 Y 3 Y 1 Y 3 Y Expense NAV (` Cr)

Debt: Short Duration -0.1 0.9 8.0 6.5 26 23 -0.1 1.1 8.8 7.2 26 23

730 BNP Paribas Short term 0.0 1.0 9.1 7.7 8 14 1.05 24.47 0.0 1.2 9.9 8.6 7 13 0.35 25.71 531

731 BOI AXA ST Incm Fund 0.0 0.6 -1.7 -3.3 26 23 1.10 16.99 0.1 0.8 -1.2 -2.7 26 23 0.53 18.11 30

732 Canara Robeco Short Duration -0.2 0.8 8.1 7.5 19 - 1.02 20.20 -0.1 0.9 8.8 8.3 19 - 0.42 21.45 1137

733 DSP Short-term Fund -0.3 0.8 8.3 7.9 17 11 0.99 36.59 -0.3 1.0 8.9 8.7 18 12 0.30 38.68 3800

734 HDFC Short Term Debt 0.0 1.3 10.1 9.1 2 1 0.74 24.54 0.0 1.4 10.5 9.3 3 5 0.24 24.90 17928

735 HSBC Short Duration -0.3 0.8 4.8 3.3 25 21 1.29 30.94 -0.2 1.1 5.8 4.3 25 21 0.29 33.31 278

736 ICICI Pru Short Term 0.0 1.3 9.9 8.6 3 3 1.16 45.73 0.1 1.4 10.7 9.5 2 1 0.40 48.41 23696

737 IDBI Short Term Bond 0.0 1.2 8.9 5.2 10 17 0.75 19.91 0.0 1.3 9.5 6.1 11 17 0.36 21.30 22

738 IDFC All Seasons Bond Fund -0.2 0.8 9.3 8.9 5 2 0.49 34.12 -0.2 0.9 9.7 9.3 9 4 0.11 35.31 155

739 IDFC Bond Short Term -0.2 0.8 8.5 8.4 14 7 0.81 44.48 -0.2 0.9 9.1 9.0 16 7 0.28 46.63 14042

740 Indiabulls ST Fund -0.1 0.9 5.8 6.1 24 15 1.43 1692.55 0.0 1.3 7.2 7.4 24 15 0.13 1845.37 27

741 Invesco India ST Fund -0.3 0.8 8.3 7.9 16 12 1.25 2821.81 -0.2 1.0 9.3 8.8 14 10 0.40 3021.41 1277

742 Kotak Bond Short-term -0.1 0.9 9.1 8.5 9 6 1.14 40.86 -0.1 1.1 9.9 9.4 5 2 0.34 43.42 19644

743 L&T Short Term Bond -0.2 0.8 8.7 8.3 13 8 0.75 20.81 -0.2 1.0 9.2 8.8 15 8 0.25 21.60 4445

744 LIC MF Short Term Debt -0.3 0.6 7.3 - 22 - 1.44 11.70 -0.2 0.9 8.4 - 22 - 0.39 11.95 661

745 Mirae Asset Short Term -0.3 0.7 7.5 - 21 - 1.17 12.36 -0.2 1.0 8.4 - 21 - 0.32 12.63 810

746 Nippon India Short-term Fund -0.1 1.0 8.5 7.9 15 10 1.17 40.53 0.0 1.2 9.4 8.7 12 11 0.32 42.71 8710

747 PGIM India Short Maturity -0.1 0.7 7.6 4.0 20 19 1.42 35.33 -0.1 0.9 8.4 4.9 20 19 0.75 37.80 48

748 Principal Short Term Debt -0.3 0.8 9.2 4.6 7 18 1.03 34.36 -0.2 1.0 9.6 5.2 10 18 0.62 36.31 152

749 SBI Short Term Debt -0.1 1.0 8.8 8.2 11 9 0.84 25.07 -0.1 1.1 9.4 8.8 13 9 0.34 26.06 23311

750 Sundaram Short Term Debt -0.1 0.7 8.2 3.1 18 22 1.01 32.22 0.0 0.9 9.0 3.8 17 22 0.28 34.41 225

751 Tata Short-term Bond Fund -0.1 0.8 8.8 5.9 12 16 1.24 37.92 -0.1 1.1 9.8 6.9 8 16 0.29 40.41 3970

752 UTI Short-term Incm Fund -0.2 0.9 9.4 3.8 4 20 0.95 23.38 -0.1 1.0 9.9 4.3 6 20 0.43 24.26 2980

Debt: Low Duration 0.1 1.0 5.8 5.0 25 25 0.2 1.1 6.4 5.5 25 25

753 ABSL Low Duration 0.0 0.8 7.1 7.6 6 4 1.22 512.56 0.1 1.0 8.0 8.5 5 2 0.40 547.97 19972

754 Axis Treasury Advtg Fund 0.1 0.9 6.8 7.7 8 3 0.61 2384.89 0.1 1.0 7.1 8.1 9 5 0.30 2464.64 10144

755 Baroda Treasury Advtg Fund 0.3 3.2 -11.5 -8.5 25 25 0.88 1535.53 0.3 3.3 -11.3 -8.3 25 25 0.67 1574.12 37

756 BNP Paribas Low Duration 0.1 0.8 6.8 7.0 9 11 1.00 31.55 0.1 1.0 7.6 7.8 7 7 0.23 33.40 380

757 Canara Robeco Savings 0.1 0.8 5.9 7.0 18 12 0.50 32.90 0.1 0.8 6.1 7.2 19 13 0.30 33.40 1395

758 DSP Low Duration 0.0 0.7 6.1 7.4 17 7 0.58 15.42 0.1 0.8 6.3 7.7 18 9 0.31 15.71 3966

759 Edelweiss Low Duration 0.2 0.9 -3.6 -0.7 24 24 1.00 2005.74 0.3 1.1 -2.8 0.1 24 24 0.20 2076.76 32

760 HDFC Low Duration 0.2 1.4 7.8 7.5 3 6 1.04 44.85 0.3 1.6 8.4 8.1 2 4 0.44 47.36 25421

761 HSBC Low Duration 0.0 0.6 2.8 2.2 22 21 1.02 16.09 0.1 0.8 3.7 3.0 22 21 0.21 17.08 140

762 ICICI Pru Savings 0.2 1.6 8.1 8.1 2 1 0.55 415.13 0.2 1.6 8.2 8.2 3 3 0.44 418.73 29895

763 IDFC Low Duration 0.0 0.8 6.3 7.3 13 9 0.51 30.03 0.1 0.8 6.6 7.6 17 12 0.28 30.43 7150

764 Invesco India Treasury Advtg 0.1 0.7 6.5 7.5 12 5 0.65 2943.85 0.1 0.8 6.8 7.9 13 6 0.32 3027.95 2818

765 JM Low Duration 0.1 0.7 26.2 5.9 1 17 0.47 29.04 0.1 0.7 26.4 6.0 1 17 0.42 29.30 124

766 Kotak Low Duration 0.1 0.9 7.3 7.7 4 2 1.15 2615.84 0.1 1.1 8.1 8.5 4 1 0.37 2757.22 11678

767 L&T Low Duration 0.1 0.8 6.1 6.0 16 15 0.95 22.02 0.1 1.0 6.7 6.6 15 15 0.30 22.70 1248

768 LIC MF Savings 0.7 1.4 7.2 6.0 5 16 0.83 31.20 0.8 1.6 7.7 6.5 6 16 0.29 32.93 955

769 Mahindra Manulife Low Duration 0.1 0.7 5.8 6.8 19 13 1.16 1288.09 0.1 0.9 6.7 7.7 16 10 0.34 1334.14 643

770 Mirae Asset Savings 0.1 0.8 6.1 6.2 15 14 0.91 1773.18 0.1 0.9 6.8 6.9 14 14 0.29 1878.20 1088

771 Nippon India Low Duration 0.2 1.0 6.7 7.1 11 10 1.04 2901.22 0.2 1.2 7.4 7.6 8 11 0.35 2993.53 8165

772 PGIM India Low Duration 0.1 0.9 1.9 -0.4 23 23 1.19 23.18 0.2 1.1 2.6 0.4 23 22 0.52 24.35 55

773 Principal Low Duration 0.1 0.7 4.4 -0.2 21 22 0.55 2713.02 0.1 0.8 4.7 0.1 21 23 0.22 2826.08 105

774 SBI Magnum Low Duration 0.1 0.8 6.3 7.4 14 8 1.01 2737.67 0.2 1.0 6.9 7.8 11 8 0.40 2780.32 16320

775 Sundaram Low Duration 0.1 0.7 5.5 3.3 20 19 0.99 25.83 0.2 0.8 6.0 3.9 20 19 0.33 26.92 433

776 Tata Treasury Advantage 0.0 0.8 6.9 5.5 7 18 0.53 3054.51 0.0 0.9 7.1 5.7 10 18 0.35 3097.22 1785

777 UTI Treasury Advtg Fund 0.1 0.8 6.7 3.2 10 20 0.45 2597.35 0.1 0.8 6.8 3.3 12 20 0.38 2626.21 3091

CCIL T Bill Liquidity Weight 0.1 0.5 2.9 3.8

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 67

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.