Page 69 - mutual-fund-insight - Mar 2021_Neat

P. 69

For more on funds, visit www.valueresearchonline.com

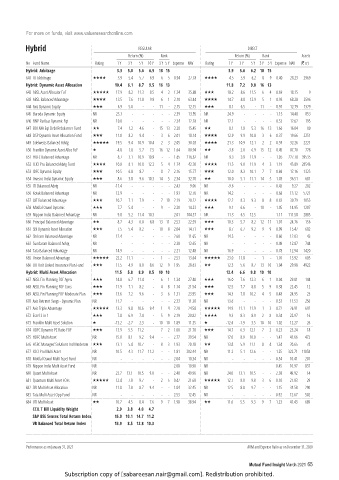

Hybrid REGULAR DIRECT

Return (%) Rank Return (%) Rank Assets

No Fund Name Rating 1 Y 3 Y 5 Y 10 Y 3 Y 5 Y Expense NAV Rating 1 Y 3 Y 5 Y 3 Y 5 Y Expense NAV (` cr)

Hybrid: Arbitrage 3.3 5.0 5.6 6.9 18 15 3.9 5.6 6.2 18 15

641 UTI Arbitrage 3.9 5.4 5.7 6.9 6 5 0.94 27.18 4.5 5.9 6.2 8 9 0.40 28.23 2969

Hybrid: Dynamic Asset Allocation 10.4 6.1 8.7 9.5 16 13 11.8 7.2 9.8 16 13

642 ABSL Asset Allocator FoF 17.9 8.2 11.3 8.5 4 2 1.34 35.88 18.2 8.6 11.5 6 4 0.69 18.15 9

643 ABSL Balanced Advantage 13.5 7.6 11.8 9.9 6 1 2.10 63.44 14.7 8.8 12.9 5 1 0.93 68.28 2596

644 Axis Dynamic Equity 6.9 5.0 - - 11 - 2.15 12.15 8.1 6.5 - 11 - 0.91 12.79 1379

645 Baroda Dynamic Equity NR 23.3 - - - - - 2.39 13.95 NR 24.9 - - - - 1.15 14.40 853

646 BNP Paribas Dynamic Eqt NR 10.0 - - - - - 2.34 12.18 NR 12.1 - - - - 0.53 12.62 195

647 BOI AXA Eqt Debt Rebalancer Fund 7.4 1.2 4.6 - 15 13 2.28 15.45 8.1 1.8 5.3 16 13 1.66 16.04 80

648 DSP Dynamic Asset Allocation Fund 11.0 8.2 9.4 - 3 6 2.01 18.14 12.9 9.9 10.8 3 6 0.37 19.66 2251

649 Edelweiss Balanced Advtg 19.5 9.4 10.9 10.4 2 3 2.05 30.03 21.3 10.9 12.1 2 2 0.59 32.26 2221

650 Franklin Dynamic Asset Alloc FoF -4.8 1.0 5.7 7.5 16 12 1.64 80.94 -3.8 2.0 6.9 15 12 0.45 87.70 778

651 HDFC Balanced Advantage NR 8.7 3.1 10.9 10.9 - - 1.65 216.62 NR 9.3 3.9 11.9 - - 1.05 227.70 39535

652 ICICI Pru Balanced Advtg Fund 10.8 8.1 10.8 12.2 5 4 1.74 42.30 11.5 9.0 11.9 4 3 1.19 45.89 28546

653 IDFC Dynamic Equity 10.5 6.8 8.7 - 8 7 2.16 15.77 12.0 8.3 10.1 7 7 0.86 17.16 1325

654 Invesco India Dynamic Equity 8.6 3.8 9.6 10.3 14 5 2.34 32.70 10.0 5.1 11.1 14 5 1.03 36.51 681

655 ITI Balanced Advtg NR -11.4 - - - - - 2.43 9.06 NR -9.6 - - - - 0.43 9.27 202

656 Kotak Balanced Advantage NR 12.9 - - - - - 1.93 12.76 NR 14.2 - - - - 0.68 13.12 5721

657 L&T Balanced Advantage 10.7 7.1 7.9 - 7 10 2.19 28.22 12.2 8.3 9.3 8 8 0.83 30.79 1055

658 Motilal Oswal Dynamic 7.7 5.4 - - 9 - 2.20 14.23 9.1 6.6 - 10 - 1.05 14.95 1207

659 Nippon India Balanced Advantage NR 9.8 5.2 11.4 10.3 - - 2.01 104.37 NR 11.3 6.5 12.5 - - 1.11 111.58 2885

660 Principal Balanced Advantage 8.7 4.3 6.8 8.8 13 11 2.53 22.59 10.3 5.7 8.2 12 11 1.07 24.76 156

661 SBI Dynamic Asset Allocation 7.5 5.4 8.2 - 10 8 2.04 14.71 8.7 6.7 9.2 9 9 0.99 15.47 602

662 Shriram Balanced Advantage NR 12.4 - - - - - 2.60 11.65 NR 14.5 - - - - 0.60 12.03 43

663 Sundaram Balanced Advtg NR - - - - - - 2.38 12.65 NR - - - - - 0.49 12.87 744

664 Tata Balanced Advantage NR 14.9 - - - - - 2.21 12.48 NR 16.9 - - - - 0.78 12.94 1420

665 Union Balanced Advantage 22.2 11.1 - - 1 - 2.53 13.64 23.0 11.8 - 1 - 1.76 13.92 605

666 UTI Unit Linked Insurance Plan Fund 11.5 4.9 8.0 8.6 12 9 1.95 28.63 12.3 5.6 8.7 13 10 1.04 29.98 4922

Hybrid: Multi Asset Allocation 11.5 5.8 8.9 8.5 10 10 12.4 6.6 9.8 10 10

667 ABSL Fin Planning FOF Agrsv 14.8 6.7 11.4 - 6 1 1.34 27.40 16.0 7.6 12.3 6 1 0.04 29.01 144

668 ABSL Fin Planning FOF Cons 11.9 7.1 8.2 - 4 8 1.14 21.54 12.5 7.7 8.8 5 9 0.38 22.45 12

669 ABSL Fin Planning FOF Moderate Plan 13.6 7.2 9.6 - 3 6 1.31 23.95 14.3 7.8 10.2 4 5 0.48 24.95 23

670 Axis Retrmnt Svngs - Dynamic Plan NR 11.7 - - - - - 2.33 11.30 NR 13.6 - - - - 0.53 11.53 256

671 Axis Triple Advantage 13.3 9.8 10.6 9.4 1 4 2.28 24.58 14.9 11.1 11.9 1 3 0.72 26.91 692

672 Essel 3 in 1 7.8 6.9 7.4 - 5 9 2.19 20.82 9.3 8.3 8.9 2 8 0.34 22.97 16

673 Franklin Multi Asset Solution -13.2 -2.7 2.3 - 10 10 1.89 11.35 -12.6 -1.9 3.5 10 10 1.02 12.27 26

674 HDFC Dynamic PE Ratio FOF 13.9 5.5 11.2 - 7 2 1.00 21.78 14.7 6.3 12.1 7 2 0.23 23.24 18

675 HDFC Multi Asset NR 15.8 8.1 9.2 9.4 - - 2.77 39.54 NR 17.0 8.9 10.0 - - 1.47 41.66 472

676 HSBC Managed Solutions Ind Moderate 13.1 5.4 10.7 - 8 3 1.93 20.18 13.8 5.9 11.1 8 4 1.34 20.65 78

677 ICICI Pru Multi Asset NR 10.5 4.3 11.7 11.2 - - 1.81 302.44 NR 11.2 5.1 12.6 - - 1.25 322.71 11058

678 Motilal Oswal Multi Asset Fund NR - - - - - - 2.04 10.34 NR - - - - - 0.54 10.41 201

679 Nippon India Multi Asset Fund NR - - - - - - 2.08 10.90 NR - - - - - 0.45 10.97 837

680 Quant Multi Asset NR 23.7 13.1 10.5 9.0 - - 2.48 49.96 NR 24.0 13.1 10.5 - - 2.38 49.92 14

681 Quantum Multi Asset FOFs 12.4 7.8 9.7 - 2 5 0.47 21.68 12.7 8.0 9.8 3 6 0.10 21.83 29

682 SBI Multi Asset Allocation NR 11.8 7.8 8.7 9.4 - - 1.84 32.45 NR 12.5 8.8 9.7 - - 1.15 34.58 290

683 Tata Multi Asset Opp Fund NR - - - - - - 2.53 12.45 NR - - - - - 0.92 12.67 502

684 UTI Multi Asset 10.7 4.5 8.4 7.6 9 7 1.98 38.94 11.6 5.5 9.3 9 7 1.23 41.43 689

CCIL T Bill Liquidity Weight 2.9 3.8 4.0 4.7

S&P BSE Sensex Total Return Index 15.0 10.1 14.7 11.2

VR Balanced Total Return Index 13.9 8.5 12.8 10.3

Performance as on January 31, 2021 AUM and Expense Ratio as on December 31, 2020

Mutual Fund Insight March 2021 65

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.